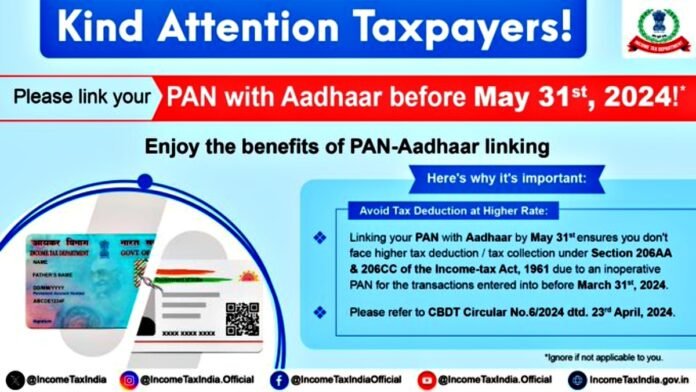

New Delhi: The Income Tax Department has issued a crucial reminder to taxpayers, urging them to link their Permanent Account Number (PAN) with their biometric Aadhaar by May 31, 2024. Failure to do so could result in tax deductions at a higher rate. Let’s delve into the specifics:

- Why Link PAN with Aadhaar?

- According to income tax rules, if your PAN is not linked to your Aadhaar, the Tax Deducted at Source (TDS) will be deducted at twice the applicable rate.

- The circular issued by the Income Tax Department last month emphasized that linking PAN with Aadhaar by the deadline would prevent any adverse actions.

- Social Media Alert:

- The IT department posted a timely reminder on the social media platform ‘X’ today or Tuesday, urging taxpayers to take action.

- The message was clear: “To avoid tax deduction at a higher rate, please link your PAN with Aadhaar before May 31, 2024.”

- Reporting Entities and SFT Filing:

- Reporting entities, including banks and foreign exchange dealers, have also been reminded to file the Statement of Specified Financial Transactions (SFT) by the same deadline.

- Entities such as sub-registrars, NBFCs, post offices, bond/debenture issuers, mutual fund trustees, and companies involved in dividends or share buybacks must comply with this requirement.

- The last date for filing SFT is May 31, 2024.

- Penalties for Non-Compliance:

- Failing to file SFT returns on time can attract penalties of up to Rs 1,000 per default day.

- Penalties may also apply for incorrect filing or non-filing of SFT.

- Vigilance on High-Value Transactions:

- The Income Tax Department closely monitors high-value transactions made by individuals through SFT.

- Ensure compliance to avoid penalties and safeguard your financial interests.

Remember, the clock is ticking! Link your PAN with Aadhaar by May 31 to stay compliant and avoid unnecessary tax deductions.

Advertisement