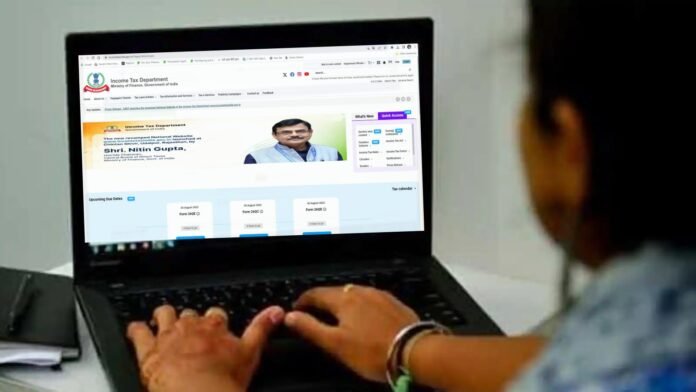

New Delhi: The Income Tax Department has announced the commencement of online filing for the financial year 2023-24 (assessment year 2024-25). Taxpayers can file ITR-1, ITR-2, and ITR-4 forms via the e-filing portal. These forms cater to individuals, professionals, and small businesses.

Filing Deadline:

The deadline for filing income tax returns for individuals not requiring an audit is set for July 31.

Eligibility for Filing:

- ITR-1: For individuals, including the salaried class and senior citizens. Salaried individuals can file after receiving Form-16 from their employer.

- ITR-2: For businesses and professionals under presumptive taxation, and individuals with an annual income below Rs 50 lakh.

- ITR-4: For resident individuals, HUFs, and firms (excluding LLPs) with a total income up to Rs 50 lakh and business/professional income computed under Sections 44AD, 44ADA, or 44AE, plus agricultural income up to Rs 5,000.

Offline Filing Availability:

Offline filing is also enabled with JSON and Excel utilities for ITR-1, ITR-2, ITR-4, and ITR-6, made available on April 1, 2024. Taxpayers must download, complete, and upload these forms on the portal.

Choosing Between Online and Offline Filing:

The choice between online and offline filing depends on individual circumstances, including internet connectivity and data volume. While paper returns are available for select taxpayers like very senior citizens, online filing is recommended for its efficiency and speed.