Key Points

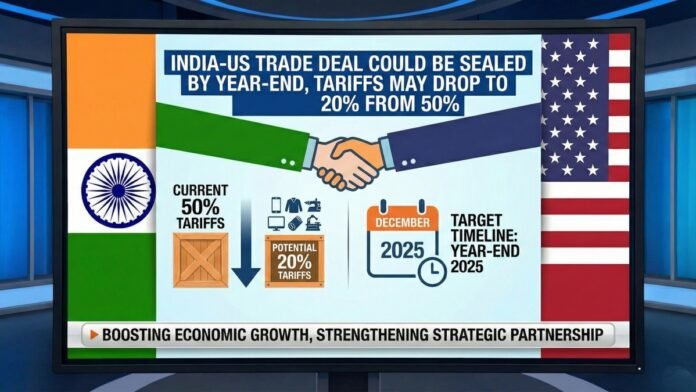

- India and US conducting dual-track negotiations, with Phase 1 focused on tariff resolution expected by year-end

- Current US tariffs on Indian goods stand at 50%, comprising a 25% base tariff plus 25% additional duty linked to Russian oil purchases

- Nomura projects post-deal tariffs could settle around 20%, providing significant relief to Indian exporters

- India’s Q2 FY26 GDP growth surged to 8.2%, exceeding RBI’s 7% expectation and most analyst forecasts

- India’s exports to US have declined 28.5% between May-October 2025 due to Trump’s tariff escalations

- RBI repo rate expected to remain unchanged or see a 25 basis point cut in December, with inflation at record low of 0.25%

- Full-year GDP growth forecast raised to 7.5% from 7% by multiple forecasters due to strong first-half performance

After six rounds of negotiations since March 2025, India and the United States have moved significantly closer to finalizing a framework trade deal by the end of 2025. Commerce Secretary Rajesh Agarwal stated that discussions have “ironed out most of the issues” and termed the current stage as “only a matter of time” for the two countries to find the “right landing zone”. The negotiations operate on two parallel tracks, with Phase 1 focusing on immediate tariff resolution and reciprocal trade issues, while Phase 2 will address the broader, long-term Bilateral Trade Agreement.

The Two-Phase Trade Deal Structure Explained

| Deal Phase | Focus Area | Timeline | Key Details |

|---|---|---|---|

| Phase 1, Tariff & Market Access | Reciprocal tariff rollback and US product concessions | Expected by Dec 2025 | 50% tariff reduction negotiated, US seeks improved market access in India |

| Phase 2, Full BTA | Comprehensive bilateral trade agreement | 2026 onwards | Aims to double bilateral trade from $191 billion to $500 billion by 2030 |

Tariff Relief, The Game-Changer For Indian Exporters

International research firm Nomura has projected that once a deal is finalized, US tariffs on Indian goods could be reduced from the current punitive 50% to approximately 20%. This reduction would comprise a base tariff of around 15-20% instead of the current 25%, plus elimination or significant reduction of the 25% additional duty linked to India’s Russian oil purchases. Such tariff relief would be transformative for Indian farmers, manufacturers, and exporters of tea, coffee, spices, and cashew nuts, who have been disproportionately impacted by Trump’s trade escalations. India’s exports to the US dropped 28.5% between May and October 2025 due to the tariff burden, making tariff normalization critical for reversing this decline.

Trump Administration Signals Positive Movement

US President Donald Trump has repeatedly indicated that a “much different deal” from previous arrangements is being finalized with India, suggesting favorable terms for both nations. Commerce Secretary Agarwal confirmed that despite trade policy shifts in Washington, discussions have advanced considerably, with both countries finding common ground on key issues. However, the Secretary cautioned that trade negotiations are inherently unpredictable, noting that “even if there is one sticking point,” a deadline might not be met. The strategic depth of the India-US relationship, underscored by a recently signed 10-year defense cooperation pact, provides a broader context for resolving trade tensions.

India’s Economy Roars Despite Trade Tensions

India’s economy demonstrated remarkable resilience in the second quarter (July-September) of FY26 with GDP growth accelerating to 8.2%, surpassing RBI’s own projection of 7% and beating most analyst expectations. Gross Value Added (GVA) expanded by 8.1%, while nominal GDP grew at 8.7%, the smallest differential since Q3 FY20, indicating broad-based economic strength. This robust performance has prompted forecasters like CareEdge to raise their full-year FY26 GDP growth forecast to 7.5% from 7%, despite projected moderation to around 6.1-7% in the second half owing to tariff impacts and normalized government spending.

GDP Drivers, Private Consumption Leads The Surge

Private consumption has emerged as the primary growth engine, bolstered by GST rate rationalization, reduced income taxes, and lower interest rates from RBI’s previous repo rate cuts. Improved rural demand and urban consumption, coupled with resilient agricultural output, have sustained growth momentum. However, manufacturing sector momentum has slowed, with the Purchasing Managers’ Index (PMI) falling to a nine-month low as Trump’s tariffs weigh on production and sales. External headwinds remain, with India’s rupee hitting a lifetime low on December 1, 2025, as weak foreign portfolio flows and stalled trade talks overshadow the impressive growth print.

Will The RBI Cut Repo Rates In December?

The Reserve Bank’s Monetary Policy Committee faces a delicate balancing act at its December 2025 meeting, with mixed signals from the economy. While inflation hit a record low of 0.25% in October 2025, supporting rate cuts, strong GDP growth of 8.2% suggests the economy doesn’t urgently need policy stimulus. Most analysts expect the RBI to either maintain the repo rate at 5.5% or deliver a modest 25 basis point cut to 5.25%. The real policy rate, currently around 1.8%, remains above the neutral range of 1-1.5%, indicating scope for reduction. However, external uncertainties from prolonged US trade negotiations and geopolitical tensions may prompt the RBI to hold steady and adopt a wait-and-see approach.

How Lower Rates Could Benefit Indian Businesses

If the RBI proceeds with a repo rate cut in December, borrowing costs for businesses and consumers would decline, potentially fueling investment and consumption. Lower rates would complement ongoing GST reforms and improved private sector confidence stemming from a potential US trade deal. Sectors like real estate, automotive, and manufacturing would benefit from cheaper credit, accelerating capital expenditure and job creation. Additionally, a rate cut could provide relief to debt-servicing costs for highly leveraged companies, improving profitability and stock market valuations.

The Rupee Weakness Paradox, Strong Economy, Weak Currency

Despite India’s impressive 8.2% GDP growth, the Indian rupee has declined to lifetime lows against the US dollar in early December 2025. This paradox stems from weak foreign portfolio inflows due to US trade tensions and the stalled India-US trade deal announcement. Capital outflows, coupled with increased import demands triggered by higher US tariffs on substitute goods, have pressured the rupee. However, India’s foreign exchange reserves have rebounded, rising by $27 billion to $693 billion as of mid-November, providing a cushion against further currency depreciation.

What A $500 Billion Trade Target Means For Both Nations

The proposed bilateral trade agreement aims to more than double current India-US bilateral trade from $191 billion to $500 billion by 2030. Achieving this target would require substantial increases in Indian IT services exports, pharmaceutical shipments, and agricultural products to the US, while expanding US machinery, semiconductors, and technology imports into India. Such an ambitious goal reflects the strategic importance both nations place on deepening economic ties, independent of short-term tariff disputes.

Sectors Most Affected By Current Tariffs

Indian exporters in agriculture, pharmaceuticals, IT services, and textiles have borne the brunt of Trump’s 50% tariffs. Farmers exporting coffee, tea, spices, and cashew nuts have faced significant margin compression and order cancellations. A successful trade deal finalizing at 20% tariffs would restore competitiveness and profitability for these sectors. Manufacturing-linked supply chains, including automotive component exports, have also suffered, with some companies reducing production or deferring expansion plans.

India stands at a critical juncture, with strong economic fundamentals supporting optimism about a year-end trade deal with the United States. While the final tariff rate negotiation continues, preliminary signals from Nomura suggest relief down to 20% is achievable. The RBI’s December policy decision on repo rates will further shape India’s growth trajectory, balancing the need for stimulus against inflation risks. Whether the trade talks conclude successfully by year-end will likely determine whether India’s impressive 8.2% Q2 growth momentum sustains into 2026 or moderates due to prolonged tariff headwinds.