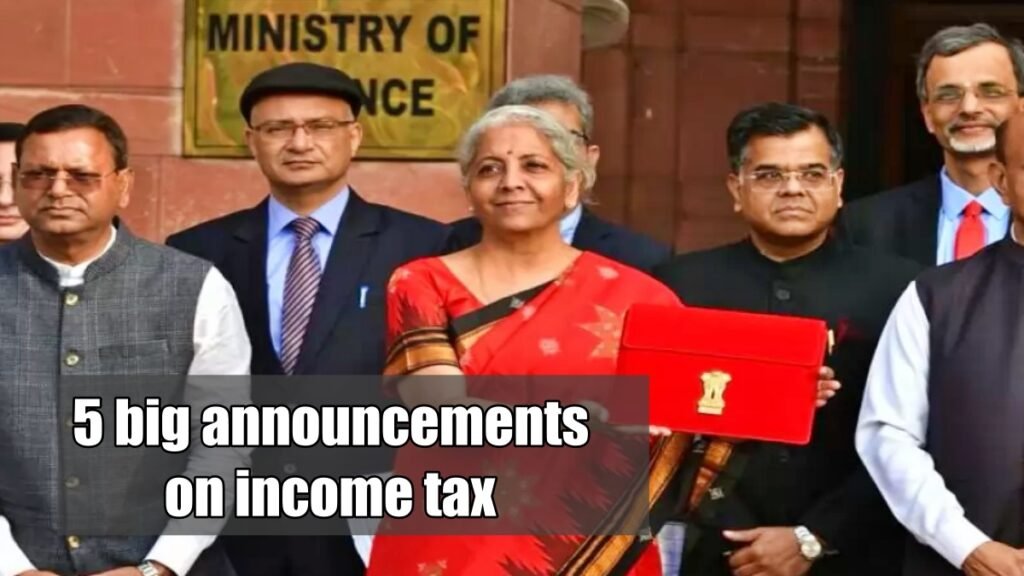

New Delhi: When Finance Minister Nirmala Sitharaman presented the General Budget 2023 on Wednesday morning, the biggest relief was given to the taxpayers. Big relief has been given to the taxpayers who were waiting for the increase in tax exemption for almost 8 years. The Finance Minister said that in the new tax regime, no tax will have to be paid on income up to Rs 7 lakh.

So far, the rebate limit in the new and old tax slabs was Rs 5 lakh, which has been increased by Rs 2 lakh to Rs 7 lakh. This means that now no tax will have to be paid till the earning of Rs 7 lakh. Apart from the rebate, the direct tax exemption has also been increased by Rs 50,000. That is, earlier when there was a direct tax exemption of up to 2.5 lakhs, it has now been reduced to Rs 3 lakhs.

Slab rates also changed

The government has also changed the rate of tax slab. Now the direct exemption of tax has been increased from 2.5 lakhs to 3 lakhs. 5% tax will have to be paid on income from 3 to 6 lakhs and 10% tax on income from 6 to 9 lakhs. Apart from this, a 15 percent tax will be charged from 9 to 12 lakhs, then 20 percent income tax will have to be paid on earnings from 12 to 15 lakhs. Earning more than 15 lakhs then will come in the slab of 30 percent.

The standard deduction also included in the new regime

This time the Finance Minister has left no stone unturned to make the new tax regime attractive in the budget. For this, in the new tax regime also, now it will be increased to a standard deduction of 52,500 thousand. That is, even if the salaried person chooses the new tax regime, he will be given the benefit of a standard deduction.

High earners benefit

This time, along with the middle class, the high-earning class has also been given relief in the budget. Earlier, on annual income of more than 15 lakhs, where the effective tax rate was 42.75 percent and 37 percent direct tax was levied. It has now been reduced to 25 percent and now the effective tax rate is 39 percent.

Higher discount on leave encashment

This time, the job profession has been specially exempted. Earlier, on retirement, the amount of up to Rs 3 lakh received by the employees in lieu of holidays was out of the ambit of tax, now this amount has been increased to Rs 25 lakh. That is, no tax will be charged on the amount received in lieu of leave on retirement up to 25 lakhs.