New Delhi: The Indian automotive industry has witnessed a remarkable close to the fiscal year 2024, with major car manufacturers like Maruti Suzuki, Tata Motors, and Mahindra & Mahindra leading the charge in domestic car sales. The data released for March 2024 indicates a significant upswing, with the total industry figures soaring by 42.51 percent. The SUV segment, in particular, has shown an impressive performance, selling 2,146,409 units and marking a growth of 27.2 percent.

Despite the overall industry growth, sedan cars have seen a slight dip in sales, with 380,135 units sold, reflecting a 5.9 percent decrease. Compact cars also experienced a downturn, with sales of 1,173,285 units, a decline of 12.4 percent.

Top Selling Manufacturers of March 2024:

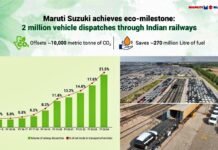

- Maruti Suzuki: Achieved a 15 percent growth in domestic passenger vehicle sales, selling 152,718 units compared to 132,763 units in the same period last year.

- Tata Motors: Witnessed a 14 percent increase in passenger vehicle sales, including electric vehicles, with sales reaching 50,297 units, up from 44,225 units last year.

- Mahindra & Mahindra: Recorded a 13 percent growth in monthly sales, with 40,631 passenger vehicles sold domestically.

- Honda Cars India: Reported domestic sales of 7,071 units and exports of 6,860 units, showing a growth in both sectors compared to last year’s figures.

- MG Motor India: Faced a 23 percent decline in sales, selling 4,648 units compared to 6,051 units in March 2023.

- Toyota: Sold 25,119 vehicles domestically and exported 2,061 units, marking a 25 percent year-on-year growth.

The table below encapsulates the sales performance of key players in the Indian auto market for March 2024:

| Manufacturer | Domestic Sales (March 2024) | Growth (%) | Export Sales (March 2024) |

|---|---|---|---|

| Maruti Suzuki | 152,718 | 15 | – |

| Tata Motors | 50,297 | 14 | – |

| Mahindra & Mahindra | 40,631 | 13 | – |

| Honda Cars India | 7,071 | 5.66 | 6,860 |

| MG Motor India | 4,648 | -23 | – |

| Toyota | 25,119 | 25 | 2,061 |

The data reflects a dynamic shift in consumer preferences, with SUVs taking the lead in sales, while traditional segments like sedans and compact cars face challenges. The industry’s adaptability and innovation continue to drive growth, setting a positive tone for the upcoming fiscal year.