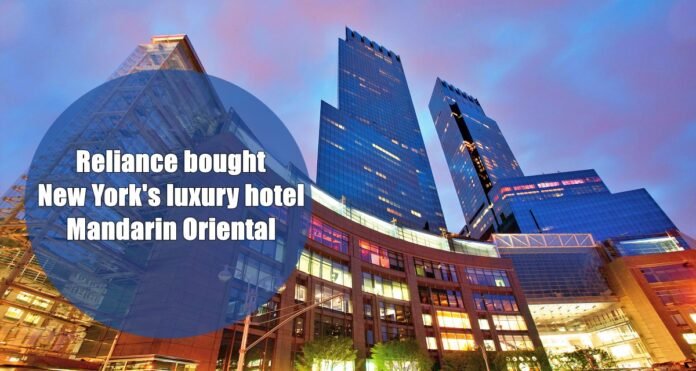

New Delhi: Billionaire Mukesh Ambani-led Reliance Industries has made another big business deal. RIL on Saturday announced the acquisition of New York’s iconic luxury hotel Mandarin Oriental for Rs 729 crore ($ 981 million). The company gave this information in a stock exchange filing. Built-in 2003, the Mandarin Oriental is an iconic hotel located at 80 Columbus Circle in New York City, right next to Central Park and Columbus Circle.

In a stock exchange information, the company said, “Reliance Industrial Investments and Holdings Limited (RIIHL), a wholly-owned subsidiary of Reliance Industries Limited (RIL), has acquired the entire issued share capital of Columbus Center Corporation (Cayman) for approximately $981 million. An agreement has been made for acquisition. It is a company incorporated in the Cayman Islands and is an indirect owner of a 73.37 percent stake in Mandarin Oriental New York. The Mandarin Oriental is one of the prestigious luxury hotels in New York City.”

Invest in Oberoi Hotels too

The acquisition is a part of RIL’s strategy to expand its consumer and hospitality business. The group has investments in EIH (Oberoi Hotels, Oberoi Hotels) and has acquired the 300-acre Stoke Park Country Club in Buckinghamshire. RIL is also developing a convention center, hotels, and residences at the Bandra-Kurla Complex in Mumbai.

Mandarin Oriental New York is located at 80 Columbus Circle, which is directly adjacent to Central Park and Columbus Circle. Its revenue was $115 million (Rs 854 crore) in 2018, $113 million (Rs 840 crore) in 2019 and $15 million (Rs 111 crore) in 2020.

Reliance will also buy the remaining part

Reliance said that the transaction is expected to be final by the end of March 2022. Other owners of the hotel will also sell their stake in this deal. The remaining 26.63% will also be acquired by RIIHL. The rest of the deal will also be at the same valuation, at which a 73.37% stake has been acquired.