New Delhi: The Modi government presented its interim budget (Interim Budget 2024) on February 1, ahead of the upcoming general elections. The budget speech, delivered by Finance Minister Nirmala Sitharaman, lasted for 58 minutes and did not announce any new scheme or any exemption in income tax for the general public. However, the budget highlighted some important points regarding the government’s vision for various sectors such as railways, defence, health, education, energy, and blue economy. Here are some of the key takeaways from the interim budget:

- Income tax: No major changes have been made in the income tax slabs in the interim budget. The existing tax rates and exemptions will continue for the next fiscal year. The government has also not introduced any new cess or surcharge on the taxpayers.

- Railways: The government has presented its vision for the development of railways and other modes of transport. It has proposed to build three new rail corridors: Delhi-Mumbai, Delhi-Kolkata, and Delhi-Chennai. These corridors will reduce the travel time and enhance the connectivity between the major cities. The government has also planned to convert 40 thousand general rail coaches into modern coaches like Vande Bharat, which will provide better comfort and safety to the passengers. The government has allocated Rs 1.1 lakh crore for the railways in the interim budget.

- Startups: The government has extended the tax exemption for startups for one more year. This means that the eligible startups can claim deduction of 100% of their profits for three consecutive assessment years out of 10 years. The government has also eased the norms for carrying forward the losses of the startups. The government has said that it will continue to support the innovation and entrepreneurship ecosystem in the country.

- Women empowerment: The government has expanded the Lakhpati Didi Yojana, which aims to provide financial assistance to the women self-help groups (SHGs). The scheme has already benefited nearly 1 crore women, who have become lakhpati (millionaire) didis. The government has now set a target of making 3 crore lakhpati didis in the next five years. The government has also announced that the Asha sisters, who are the frontline health workers, will also be given the benefits of the Ayushman Yojana, which provides health insurance coverage of Rs 5 lakh per family per year. The government has also focused on the cervical cancer vaccination for the girls aged 9-14 years, as part of its maternal and childcare schemes.

- Infrastructure: The government has increased the spending on infrastructure by 11 percent. The government has said that it will continue to provide interest-free loans to the states for infrastructure development. The government has also launched a new scheme under Blue Economy 2.0, which will promote the sustainable use of ocean resources. The scheme will involve the establishment of five integrated aquaparks, which will provide employment opportunities to 55 lakh people. The scheme will also boost the fisheries sector, which has already benefited from the Matsya Sampada Yojana. The government has also announced that it will promote the infrastructure of Lakshadweep, which is a strategically important island territory. The government has also said that it will promote electric vehicles and renewable energy sources, as part of its commitment to fight climate change.

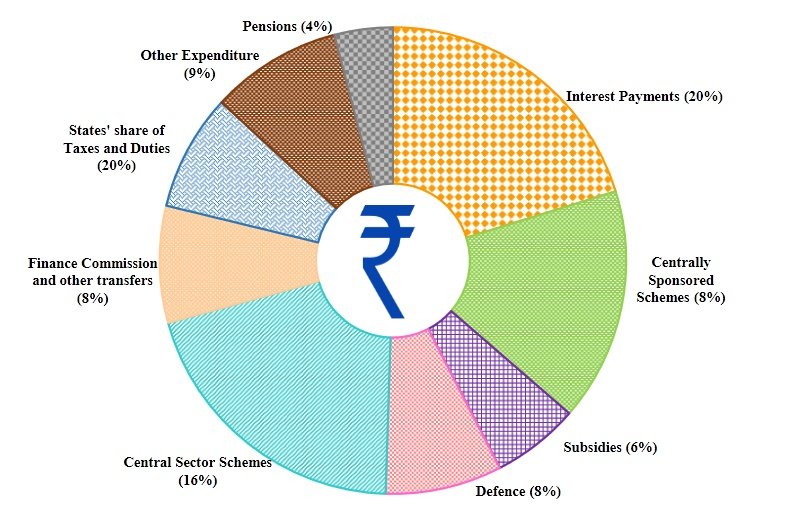

- Defence: The government has increased the defence spending by 11.1 percent. This will amount to 3.4 percent of the GDP. The government has allocated Rs 6.2 lakh crore for the defence sector, which is the highest ever. The government has said that it will strengthen the defence capabilities of the country and ensure the security of the borders. The government has also said that it will continue to support the welfare of the defence personnel and their families.

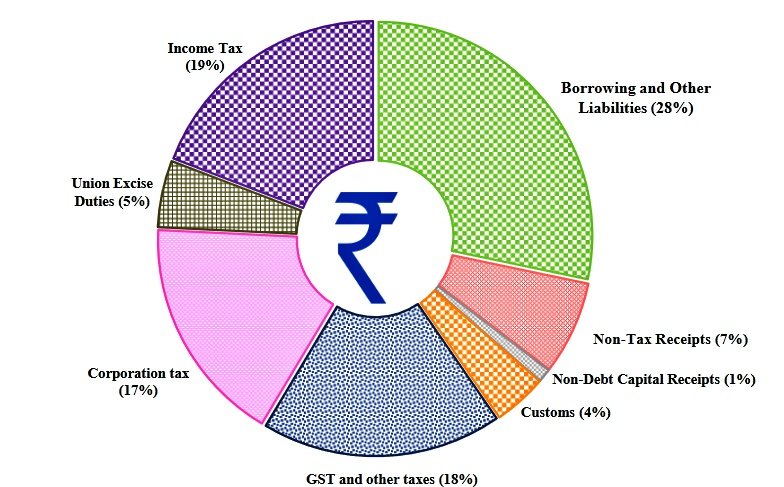

- Fiscal deficit: The government has estimated the fiscal deficit to be 5.1 percent of the GDP for the current fiscal year. This is higher than the target of 4.5 percent set by the previous budget. The government has attributed this to the impact of the Covid-19 pandemic and the stimulus measures taken to revive the economy. The government has said that it will bring down the fiscal deficit to 4.5 percent by 2025-26. The government has estimated the expenditure to be Rs 44.90 lakh crore and the revenue to be Rs 30 lakh crore for the current fiscal year.

- Education: The government has claimed that it has established 390 new universities and 3000 new ITIs in the country. The government has also said that it has trained 1.4 crore youth under the Skill India Mission, which aims to provide them with employable skills. The government has also said that it has achieved one market, one tax through the GST, which has simplified the tax system and increased the tax base. The government has also said that it has taken a transformative initiative through the India-Middle East-Europe Economic Corridor, which will enhance the trade and investment opportunities for the country.

- Social welfare: The government has said that it has provided help to 78 lakh street vendors under the PM SVANidhi scheme, which provides them with loans of Rs 10,000 to restart their businesses. The government has also said that it has given the benefit of PM Crop Insurance Scheme to 4 crore farmers, who are protected from the risks of crop failure due to natural calamities. The government has also said that it has given financial help to 11.8 crore farmers under the PM Kisan Yojana, which provides them with Rs 6,000 per year. The government has also increased the budget for MNREGA, which provides 100 days of guaranteed employment to the rural poor, from Rs 60 thousand crore to Rs 86 thousand crore. The government has also said that it has removed the poverty of 25 crore people in the last seven years. The government has also said that it has sanctioned 43 crore loans worth Rs 22.5 lakh crore under the PM Mudra Yojana, which provides loans to the micro and small enterprises. The government has also said that 30 crore of these loans were given to the women entrepreneurs. The government has also said that it has sent Rs 34 lakh crore to the accounts of the people under the Garib Kalyan Yojana, which provides various benefits such as free food grains, gas cylinders, cash transfers, etc.

- Housing: The government has announced that it will bring a new housing scheme for the middle class, which will provide affordable and quality houses to them. The government has said that it will build 2 crore houses in the next five years under this scheme. The government has also said that it has already built 3 crore houses under the PM Awas Yojana, which provides housing for all.

The interim budget is a temporary budget, which is presented in an election year. The next government will present the full budget after the elections. The interim budget does not have many changes or announcements, but it reflects the government’s vision and priorities for the various sectors of the economy. The interim budget also showcases the government’s achievements and initiatives in the last seven years.