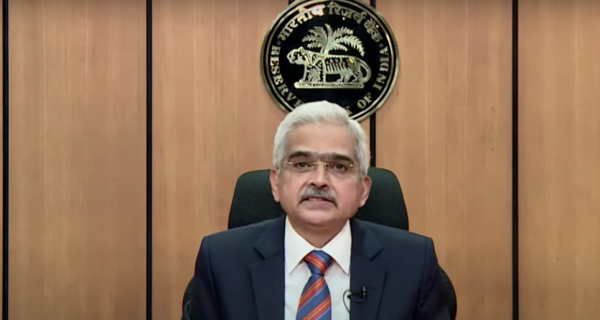

New Delhi: Reserve Bank of India (RBI) governor Shaktikanta Das Wednesday said it held an off cycle-meeting amid high inflation and voted to increase the repo rate by 40 basis points, citing persistent inflationary pressures in the economy. Further, in keeping with the stance of withdrawal of accommodation, it has been decided to increase the Cash Reserve Ratio by 50 basis points to 4.50 percent, said, Shaktikanta Das. CRR hike can suck out liquidity to the tune of Rs 83711.55 crore, he said. CRR hike will be effective from midnight of May 21.

What is Repo Rate and Why Is It Important

Every time commercial banks fall short of funds, they approach the RBI to borrow money. The RBI lends money to these banks at a particular rate which is known as the repo rate. The RBI decides periodically whether to hike/slash the rate or leave it unchanged. The central bank’s monetary policy committee’s decision could impact liquidity and inflation in the Indian economy.

The repo rate is a very important tool for the RBI to control inflation trends. Raising or cutting the rates by the RBI will make borrowing more expensive or cheaper for commercial banks. The repo rate and inflation have an inverse relationship. If the rate is increased, it will bring down inflation and if the rate is lowered, inflation will go up.

What It Means For Home Loan, Auto Loan Borrowers

RBI’s surprise move to increase repo-rate will make your bank increase interest rates on loans. So, your home loans, and auto loans are set to become costlier.