Key Points

- Piyush Goyal met Starlink executives to discuss investment, partnerships, and regulatory hurdles.

- Starlink has partnered with both Reliance Jio and Bharti Airtel to bring high-speed satellite internet to India.

- The rollout hinges on spectrum allocation and security clearances from Indian authorities.

- TRAI is considering a shorter 5-year spectrum license, while Starlink seeks a 20-year term.

- Starlink’s entry could revolutionize rural connectivity but faces pricing and policy challenges.

New Delhi: The competition to provide satellite internet in India has intensified, with Union Commerce and Industry Minister Piyush Goyal recently holding crucial talks with a delegation from Starlink, SpaceX’s satellite internet arm. The meeting, attended by Starlink Vice President Chad Gibbs and Senior Director Ryan Goodnight, focused on the company’s advanced technology, current partnerships, and ambitious investment plans for India.

Jio and Airtel Join Forces with Starlink: What’s at Stake?

In a major industry shakeup, both Reliance Jio and Bharti Airtel have inked agreements with Starlink to deliver high-speed, low-latency satellite broadband across India. These partnerships aim to extend reliable internet to remote and rural areas where traditional networks struggle, potentially bridging India’s stubborn digital divide.

- Airtel’s Approach: Focuses on using Starlink to complement existing broadband, targeting rural schools, health centers, and communities.

- Jio’s Strategy: Plans to retail Starlink equipment through its vast network, offering installation support and integrating satellite internet into its broader ecosystem.

Both companies, however, must wait for SpaceX to secure the necessary regulatory approvals before Starlink can officially launch in India.

Regulatory Roadblocks: Spectrum, Security, and Policy

Starlink’s expansion is stalled by two major hurdles: security clearance and spectrum allocation. The Telecom Regulatory Authority of India (TRAI) is expected to recommend a five-year spectrum license, much shorter than Starlink’s requested 20-year term. This shorter duration is favored by Jio and Airtel, who argue it allows for market reassessment, while Starlink contends that longer terms are needed for affordable pricing and long-term planning.

Additionally, Starlink must comply with stringent Indian mandates, including setting up a local control center and allowing lawful interception by authorities. Pricing of satellite spectrum remains under discussion, with Starlink advocating for administrative allocation at a fraction of adjusted gross revenue, while local telcos push for parity with terrestrial spectrum fees.

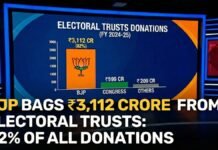

Starlink vs. Indian Rivals: The Numbers Game

| Provider | Satellites Deployed | Current Status in India | Key Indian Partners |

|---|---|---|---|

| Starlink (SpaceX) | 6,750+ | Awaiting full regulatory nod | Jio, Airtel |

| Eutelsat OneWeb | ~600 | Licensed, pending spectrum | Bharti Group |

| Jio-SES | ~70 | Licensed, pending spectrum | Reliance Jio |

Starlink’s vast constellation gives it a technological edge, promising internet speeds up to several terabits per second—significantly outpacing rivals like Eutelsat OneWeb and Jio-SES, which offer 30-50 Gbps.

India’s Digital Future: Promise and Challenges

Starlink’s arrival could be transformative, especially for rural India, where nearly 40% of the population lacks internet access. Its satellite technology bypasses the need for costly terrestrial infrastructure, making it ideal for hard-to-reach regions. However, high hardware costs (₹25,000–₹35,000) and monthly fees (₹5,000–₹7,000) may limit mass adoption unless subsidized or tailored for the local market.

The government is closely monitoring how satellite broadband could disrupt existing telecom dynamics and whether Starlink’s entry will foster competition or reinforce the dominance of Jio and Airtel.

What’s Next?

Starlink’s fate in India now depends on TRAI’s final spectrum policy and the resolution of security and compliance requirements. If cleared, Starlink—backed by the distribution muscle of Jio and Airtel could redefine India’s internet landscape, connecting millions in the remotest corners and setting a new benchmark for digital inclusion.