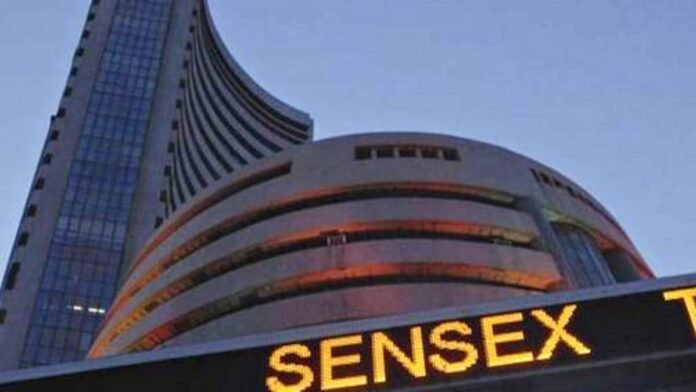

New Delhi: Indian stock markets witnessed a sharp decline on Tuesday, with the BSE Sensex plunging over 900 points and the NSE Nifty dropping by 1%, dragged down by a combination of domestic and global pressures. Key triggers included a heavy sell-off in Adani Group stocks, intensified geopolitical tensions, and sustained foreign institutional investor (FII) outflows.

Intraday Market Performance: Sensex and Nifty on the Edge

- Sensex: Opened at 77,711.11 and hit an intraday low of 76,802.73, marking a loss of over 900 points. By mid-session, it showed modest recovery, trading at 77,127.42.

- Nifty: Dropped by 179.75 points, reaching 23,338.75 in early trading.

This steep fall erased significant market gains, leaving investors jittery as uncertainties loomed over both domestic and global fronts.

Key Factors Behind the Market Sell-Off

1. Adani Group Stock Rout Amid Bribery Allegations

The US Securities and Exchange Commission (SEC) filed charges against billionaire Gautam Adani and his associates for alleged bribery and fraud. This has severely impacted Adani Group stocks, leading to a domino effect on broader indices. Investors dumped shares fearing regulatory crackdowns and reputational damage to one of India’s largest conglomerates.

2. Escalating Geopolitical Tensions

Renewed hostilities in the Russia-Ukraine conflict added to global market volatility. Investors have turned risk-averse as rising oil prices and supply chain disruptions threaten economic recovery worldwide.

3. Persistent FII Outflows

Foreign institutional investors have been on a selling spree, further pressuring Indian equities. Analysts attribute this to a stronger US dollar, higher bond yields, and an aversion to emerging market risks amid geopolitical and financial uncertainties.

Sectoral Impact and Key Losers

- Adani Group Stocks: Plummeted sharply, with major entities like Adani Enterprises and Adani Ports leading the decline.

- Banking & Financials: Suffered significant losses as investors feared a ripple effect from Adani-linked exposures.

- Technology & Energy: Global weaknesses dragged down IT and energy sectors.

Global Market Context

The Indian markets weren’t alone in facing headwinds. Major global indices showed mixed performances as inflation concerns and geopolitical tensions kept sentiment subdued. The US Federal Reserve’s stance on interest rates continues to influence FIIs, further exacerbating outflows from Indian markets.

Outlook: What Lies Ahead?

Analysts suggest that market recovery hinges on multiple factors:

- Adani Controversy: Resolution or further escalation in the bribery allegations could steer market direction.

- Geopolitical Stability: Any de-escalation in the Russia-Ukraine conflict might offer temporary relief.

- FII Trends: Continued outflows could maintain downward pressure on the indices.

Expert Take:

Market expert Rajesh Agarwal noted, “The combination of corporate scandals, geopolitical instability, and global economic uncertainty has created a perfect storm. Investors should adopt a cautious approach in the near term.”

Investor Caution Amid Uncertainty

With mounting domestic and global challenges, Indian equities face a volatile path ahead. The Sensex and Nifty declines serve as a stark reminder of the fragile market conditions, urging investors to tread carefully. Whether the market stabilizes or continues its downward trend will depend on how these unfolding events are addressed.