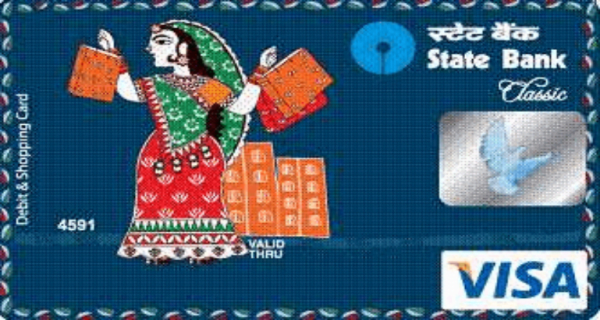

New Delhi: The country’s largest lender State Bank of India (SBI) has sent a special message to its customers. In this, customers have been told that some of the services on their credit and debit cards are being discontinued from 30 September 2020. The bank has said that this decision has been taken on the basis of new rules issued by the Reserve Bank of India (RBI), which are coming into force exactly two days later. These services are linked to international transactions. The bank has said that if you want to continue shopping in international markets on your card, then write the last 4 digits of your card number and text it to 5676791 after INTL. Let us know what the RBI has changed in the rules for cardholders.

Rules to come into force in January 2020, postponed due to Covid-19

The Reserve Bank is changing several rules related to debit and credit cards from 30 September 2020. If you use debit and credit card, then it is important for you to know about this news. In view of the extraordinary situation due to the Covid-19 epidemic, the card issuers have been given time till September 30 by the RBI to implement the rules. Earlier these rules were to come into force in January 2020, but they were postponed till March. Later, they were postponed due to Covid-19 and now they are being implemented from 30 September.

Customer will have to register himself, priority on the transaction

According to the new RBI rules, customers have to register separately for international, online, and contactless card transactions. Meaning that the customer will get this service only if he needs it. If you understand in easy language, then customers will have to apply for it now. RBI has told banks that customers should allow domestic transactions while issuing debit and credit cards. It is clear that if there is no need, withdraw money from the ATM machine and do not allow foreign transactions for shopping at the POS terminal.

Now the customer can change his transaction limit anytime

For existing cards, issuers can decide based on their risk perception. In other words, now you have to decide whether you want a domestic transaction or an international transaction with your card. Now the customer will decide which service to activate and which activator. The customer can also change the limit of his transaction 24 hours a day. In other words, now you can set your ATM card by going to the mobile app, internet banking, ATM machine, transaction limit at any time through IVR.