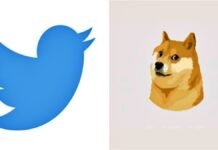

New Delhi: Indian investors investing in cryptocurrencies like Bitcoin and Dogcoin have been hit hard by the Reserve Bank of India (RBI). In fact, cryptocurrency exchanges in the country are facing difficulties in securing secure payment solutions for transactions. Industry sources said that banks and payment gateways have started terminating their partnerships with cryptocurrency exchanges following warnings from the RBI. The RBI had said that it was not in favor of cryptocurrencies. The main reason for this is apprehension about their impact on financial stability. The central bank had informally asked Indian banks to distance themselves from these exchanges.

Impact of transaction due to closure of payment gateways

Complaints from users about cryptocurrency exchanges are on the rise. In fact, the termination of services of large payment gateways has affected transactions. Avinash Shekhar, co-chief executive of ZebPay, one of the country’s oldest cryptocurrency exchanges, said banks are now reluctant to do business. We are in talks with a number of payment partners, but have not had much success. Cryptocurrency exchanges are now considering other options. These include joining hands with small payment gateways, building your own payment processors and halting immediate settlement.

Two crypto exchanges have partnered with AirPay

Major payment gateways such as Razorpay, PayU, and BillDesk have broken off partnerships with cryptocurrency exchanges. In fact, even these payment gateways depend on banks for processing transactions. The two crypto exchanges have partnered with AirPay, a small payment processing firm. Explain that at present there are about 15 million crypto investors in the country. Among these, there is a huge craze for investing in Bitcoin and Dogcoin, the world’s most popular cryptocurrencies.