Washington: After Silicon Valley Bank (SVB) in America, regulators have locked another bank. It was the second largest bank after Silicon Valley to close. The disintegration of 2 banks within just a week is enough to create a very frightening situation for any country. This is being seen as the beginning of the economic recession because the recession of 2008 was also seen only after the bank crash.

Although the US authorities told on Sunday what efforts they are making to save the depositors’ money in Silicon Valley Bank. The authorities promised that every requirement of the customers would be met. In a joint statement, financial agencies including the US Treasury said that SVB depositors will be given access to their money from Monday (March 13) and also said that US taxpayers will not have to foot the bill.

Heavy fall in the global market due to the drowning of US banks

After the news of the bank crash, a bloodbath has also been seen in the stock market around the world. It has got a good impact on the Indian market as well. Till the time of writing the news, both the main Sensex have fallen. There is a decline of about 0.84 percent in the Sensex, while the Nifty50 has fallen by 1.06 percent. It showed more impact on the Indian banking sector. Nifty Bank has declined by about 2 percent.

On the other hand, Europe’s largest bank HSBC said on Monday that it has acquired the United Kingdom unit of the closed Silicon Valley Bank. The UK government said that no taxpayer’s money has been used in this acquisition and the deposits of the customers have been secured.

1 lakh people can be unemployed

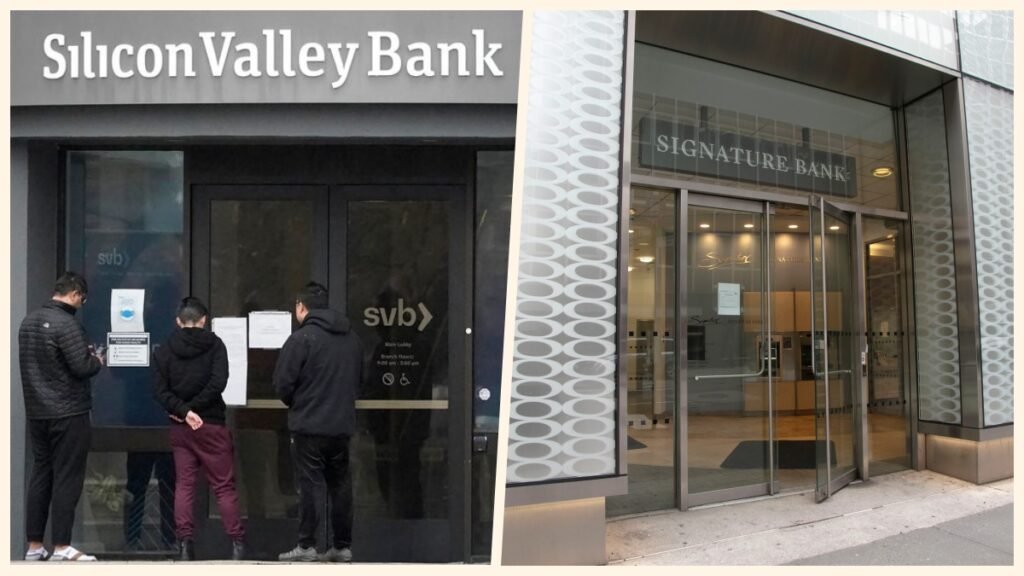

It was reported on Friday itself that the Silicon Valley Bank (SVB) has collapsed. This bank was mainly the backbone of venture capital financing for the Tech Sector. On its breaking, speculations are also being made that it will give a big blow to 10,000 startups and will affect the employment of about 1,00,000 (1 lakh) people. The market had not yet recovered from its shock that on Sunday itself the New York Railguters informed about the collapse of another bank (Signature Bank).

The regulators announced that Signature Bank has also been seized on Sunday. This bank has assets worth $110 billion. Peeping in the history of America, it is known that this is the third largest bank failure. Silicon Valley Bank is the largest retail bank to collapse after the 2008 financial crisis.

The government will assess the impact of the collapse of SVB

The collapse of troubled banks in America is bound to affect India. In such a situation, the Government of India is also constantly monitoring it. Minister of State for Electronics and IT, Rajeev Chandrasekhar said that he will meet people in tech startups and try to find out how it will affect India.

He tweeted that ‘the closure of the bank will definitely be a problem for startups around the world. Startups are an important part of the economy of New India. I will meet people from Indian startups this week to assess its impact and try to find out how the Narendra Modi government can help them in this time of crisis.