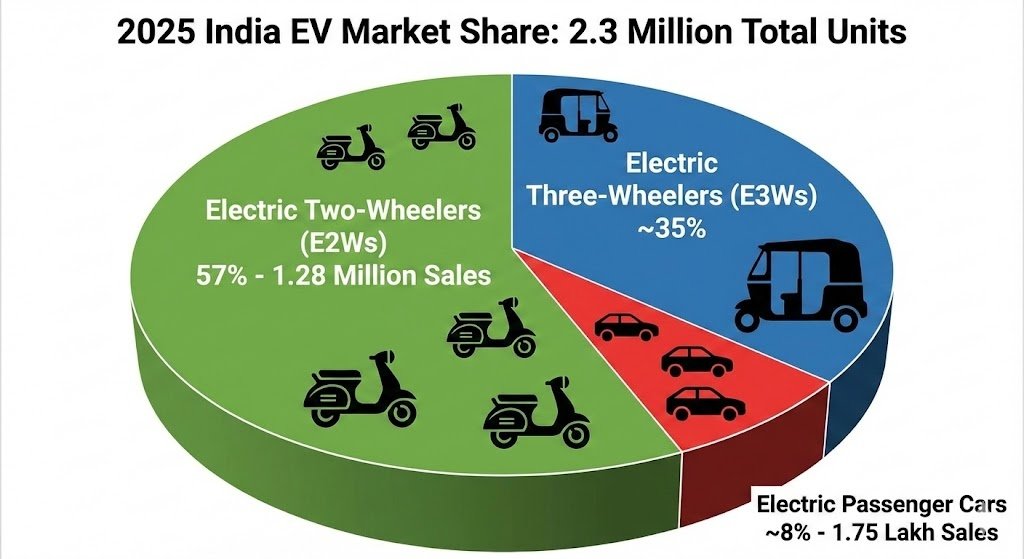

India’s transition to electric mobility has officially shifted into high gear, but the revolution is rolling on two wheels, not four. By 2025, the Indian electric vehicle (EV) market crossed a historic milestone, with total EV sales surpassing 2.3 million units. However, a deeper dive into the numbers reveals a stark dichotomy in consumer adoption.

While electric two-wheelers (E2Ws) have achieved mass-market momentum, crossing 1.28 million annual sales and capturing 57% of the entire EV market, electric passenger cars are struggling to keep pace, languishing at under 2% of total car sales despite consistent year-on-year growth.

Here is a detailed breakdown of the data, the drivers, and the roadblocks defining India’s EV landscape.

The Two-Wheeler Takeover: Hitting the 1.28 Million Mark

The staggering success of the electric two-wheeler segment is the defining story of India’s green mobility transition. In 2025, E2W sales surged past 1.28 million units. This wasn’t just a marginal increase; it represented a maturation of the market where EVs accounted for over 6% of all two-wheelers sold in the country.

Key Drivers of the E2W Boom:

- Cost Parity: The gap between internal combustion engine (ICE) scooters and electric scooters has practically vanished. With battery prices stabilising and favourable taxation, the total cost of ownership (TCO) for an electric scooter is now undeniably cheaper than its petrol counterpart.

- Fierce OEM Competition: Legacy players and agile startups have flooded the market with highly capable, tech-loaded products. Companies like TVS Motor, Bajaj Auto, Ather Energy, and Ola Electric fiercely competed in 2024 and 2025, driving innovation up and prices down.

- The B2B Delivery Surge: The gig economy relies on tight margins. Delivery fleets (Zomato, Swiggy, Zepto, Amazon) aggressively transitioned to electric fleets in 2024–2025 to slash operational costs, creating a massive bulk-buying pipeline for EV manufacturers.

- Home Charging Convenience: Unlike car owners who might need specialised parking and fast chargers, a scooter battery can often be charged via a standard 15-amp wall socket or even removed and charged inside an apartment.

The Four-Wheeler Friction: Why Cars Remain Under 2%

While electric two-wheelers and three-wheelers (which make up another ~35% of EV sales) are flying out of showrooms, the passenger electric car market tells a different story. Despite selling roughly 1.75 lakh units in 2025 and showing strong double-digit YoY growth, electric cars remain under 2% of the colossal 4.4 million+ passenger vehicles sold annually in India.

Why is the four-wheeler segment hitting a speed bump?

- The “Mass Market” Void: The Indian car market is heavily skewed toward vehicles priced under ₹12 lakh. Currently, the EV car market lacks diverse, uncompromised options in this price bracket. While Tata Motors and MG Motor have introduced entry-level EVs, the bulk of high-quality, high-range EV options sit in the premium ₹15–₹30 lakh segment, alienating the budget-conscious middle class.

- Range and Infrastructure Anxiety: While home charging works for daily city commutes, highway charging infrastructure remains patchy. Fast chargers are concentrated in Tier-1 cities and select highways. For a one-car middle-class Indian family, an EV still feels like a risky bet for a 500 km inter-city road trip.

- High Upfront Premium: Despite lower running costs, the initial acquisition cost of an electric car is still 30% to 40% higher than its exact petrol/diesel equivalent. Without heavy subsidies for private electric cars, this premium is a massive psychological and financial barrier.

- Resale Value Uncertainty: The secondary market for electric cars in India is still in its infancy. Buyers remain hesitant about battery degradation over 5–8 years and the subsequent impact on the car’s resale value.