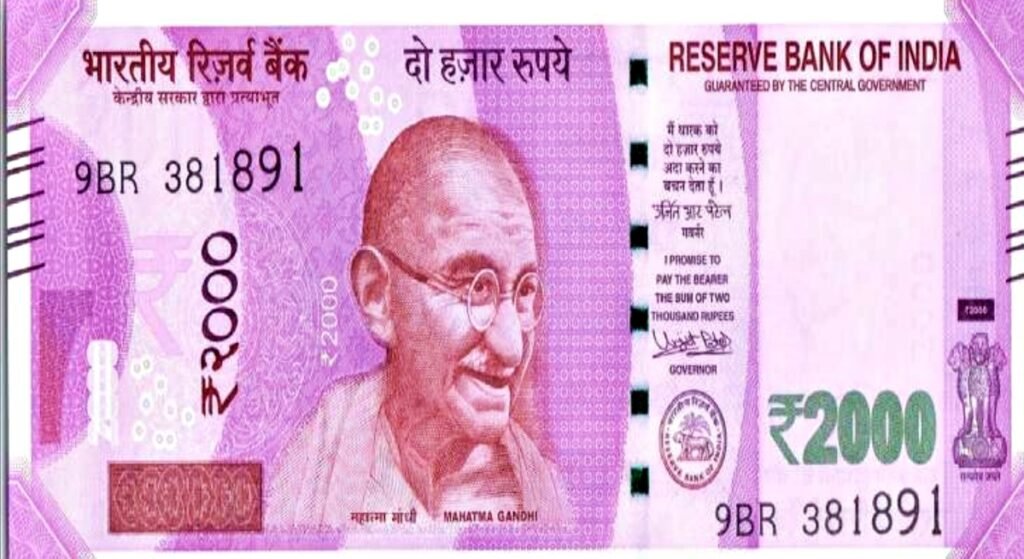

New Delhi: The Reserve Bank of India (RBI) has announced that it has extended the deadline for exchanging Rs 2,000 notes till October 7, 2023. The RBI had earlier decided to withdraw the legal tender status of Rs 2,000 notes from September 30, 2023, as part of its ‘Clean Note Policy’. However, based on a review of the withdrawal process, the RBI has decided to give more time to the public to exchange or deposit the demonetised notes.

The RBI said in its statement, “Since the period specified for the withdrawal process has ended, it has been decided to extend the present arrangement for deposit/exchange of Rs 2,000 bank notes till October 07, 2023.”

The RBI had introduced Rs 2,000 denomination notes in November 2016 under Section 24(1) of the Reserve Bank of India (RBI) Act, 1934. This was done to rapidly meet the currency requirement of the economy after withdrawal of the legal tender status of all Rs 500 and Rs 1000 bank notes in circulation at that time.

According to Minister of State Pankaj Chaudhary, the objective of introducing the notes was achieved when bank notes of other denominations became available in sufficient quantity. He said, “In view of this and under the ‘Clean Note Policy’ of RBI, it has been decided to withdraw the notes.”

How to exchange or deposit Rs 2,000 notes?

The public can exchange or deposit Rs 2,000 notes at any nearest bank branch or at any of the 19 regional branches of RBI till October 7, 2023. To do so, they have to fill a ‘request slip’ with their details and the number of notes they want to exchange or deposit. They also have to provide their Unique Identification Number mentioned on documents like Aadhaar, Driving License, Voter ID Card, Passport, or NREGA Card.

The RBI has also set a limit on how many Rs 2,000 notes can be exchanged at a time. The maximum value of Rs 2,000 notes that can be exchanged at a time is Rs 20,000.

What will happen to the remaining Rs 2,000 notes?

According to the latest report of RBI, till now about 96 percent of the currency notes have returned to the banking system. Now only Rs 0.14 lakh crore notes are in the market.

According to data received from banks, the total value of Rs 2000 bank notes withdrawn from circulation till August 31, 2023 was Rs 3.32 lakh crore.

The RBI has not specified what will happen to the remaining Rs 2,000 notes after October 7, 2023. However, it is likely that they will cease to be legal tender and will become invalid for any transaction. The public is advised to exchange or deposit their Rs 2,000 notes before the deadline to avoid any inconvenience.