Key points

- Four labour codes, on wages, industrial relations, social security and occupational safety, are now in force nationwide from 21 November 2025, replacing 29 central labour laws.

- The codes introduce a national floor wage, a uniform definition of wages and wider social security coverage, including for gig and platform workers.

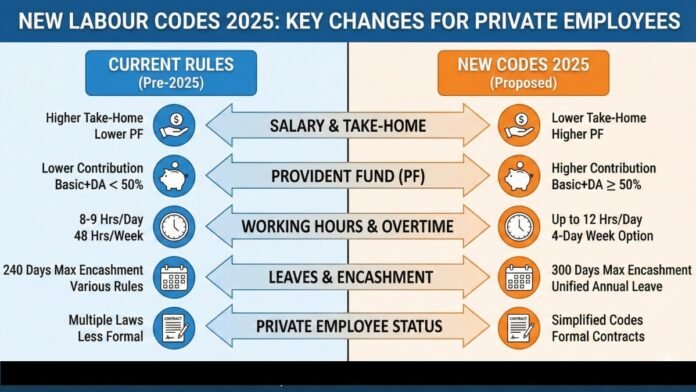

- Minimum basic plus key allowances must now be at least 50 percent of total pay, which can reduce in hand salary but boosts PF, gratuity and future pension benefits.

- Fixed term employees get equal benefits as permanent staff and become eligible for gratuity after one year, while appointment letters and digital registers are now mandatory for all workers.

- Trade unions have criticised the codes as anti worker, citing easier hire and fire provisions and concerns over dilution of some protections, even as industry welcomes compliance simplification.

The government has formally implemented all four labour codes, the Code on Wages 2019, Industrial Relations Code 2020, Code on Social Security 2020 and OSH Code 2020, with effect from 21 November 2025 across India. These codes subsume and rationalise 29 earlier central labour laws that were drafted for a very different industrial era, aiming to create a more modern, uniform and digital-friendly framework for today’s mixed economy.

Central notifications are in place, but several detailed rules, especially under state governments, are being phased in, which means there will be a transition period where some old rules and schemes continue alongside the new framework until they are fully harmonised. Employers have been advised to review HR, payroll, contracts and vendor arrangements immediately, since the definitions and thresholds that trigger compliance have changed, even if practical enforcement ramps up gradually.

Ten major changes explained

The first big shift is universal minimum wage protection, with the Code on Wages extending the statutory right to minimum wages to all employees, not just those in scheduled industries, and empowering the Centre to set a national floor wage that states cannot undercut. This is expected to raise earnings in low-paid sectors like small services, retail and contract work in states that currently pay very low rates.

Second, a standardised definition of wages means that basic pay, dearness allowance and retaining allowance must together form at least 50 per cent of total remuneration, with all excluded allowances capped at the remaining 50 per cent. As a result, many employers will have to increase basic pay and reduce miscellaneous allowances, which pushes up the base for PF, gratuity and other benefits, often lowering the monthly take-home but improving long-term savings.

Third, social security coverage is broadened, with the Social Security Code consolidating nine earlier laws and extending EPFO and ESIC architecture more uniformly to eligible establishments, including newer service and IT sectors. Gig workers, platform workers and many unorganised sector workers are now explicitly recognised, with provisions for a social security fund financed partly by aggregators, governments and penalties, which can support schemes for life cover, accident insurance and old age protection.

Fourth, working hours retain the 8-hour day and 48-hour week cap, but governments can now design 4-day, 5-day or 6-day workweeks as long as the weekly limit is respected, with any overtime paid at least at double the usual rate. This creates room for compressed workweeks and more flexibility in IT, manufacturing and services, while still binding employers to stricter documentation and compensation for extra hours.

Fifth, leave rules are made more employee-friendly, with eligibility for annual paid leave now arising after 180 days of work instead of 240, and more uniform norms for leave accrual, carry forward and encashment. This reduces the scope for arbitrary denial of leave in smaller private establishments and ensures newer hires can access paid time off sooner.

Sixth, appointment letters are now mandatory for every employee, including many informal white collar and blue-collar roles that earlier relied on verbal offers or simple emails. Standardised formats and digital registers are being prescribed, which help workers prove service history when claiming PF, gratuity, bonus or contesting wrongful termination.

Seventh, fixed-term employment is fully recognised, with the codes mandating equal pay and benefits for fixed-term staff compared with permanent workers doing similar work, and making them eligible for gratuity after just one year of continuous service. This can make project-based contracts less exploitative and more attractive, particularly for skilled professionals who move between assignments.

Eighth, the framework for women workers is strengthened, explicitly prohibiting gender based wage discrimination and reaffirming equal pay for equal work while formally allowing women to work night shifts in all sectors with their consent. Employers must provide specified safety measures, such as secure transport, adequate lighting and CCTV, which is expected to open more opportunities for women in IT, BPO, hospitality and retail.

Ninth, health and safety rules under the OSH Code extend coverage to more establishments, including small units and even single-worker hazardous activities, and provide for annual health check-ups and better welfare facilities in many workplaces. This raises compliance expectations for private workshops, warehouses and service units that previously fell outside most safety regimes.

Tenth, employers benefit from simplified compliance promises, with the idea of one registration, one licence and one return replacing multiple overlapping filings under older Acts, and the option of all India licences for contractors. At the same time, thresholds under the contract labour and factory provisions are revised, for example, many contract labour obligations now apply from 50 contract workers upward, which eases the load on small units but keeps full protections for larger establishments.

Impact on private sector employees

For most private sector employees, the immediate, visible impact will be a restructuring of salary slips, with higher basic pay, bigger PF and gratuity bases and sometimes a small reduction in cash in hand, while overall cost to the company remains similar. Over a career, though, a stronger wage base and mandatory social security coverage should translate into higher retirement savings, better gratuity cheques and more predictable benefits, especially for mid and long-term employees.

Workers are advised to carefully read new appointment letters and HR communications, check whether the 50 percent wage rule is being followed, track their PF and ESIC numbers, and understand eligibility for gratuity, leave and overtime under the new codes. At the same time, trade unions and labour groups are planning challenges and protests, arguing that the Industrial Relations Code makes layoffs and retrenchment easier in larger units, which means the political and legal landscape around these reforms may keep evolving in the months ahead.