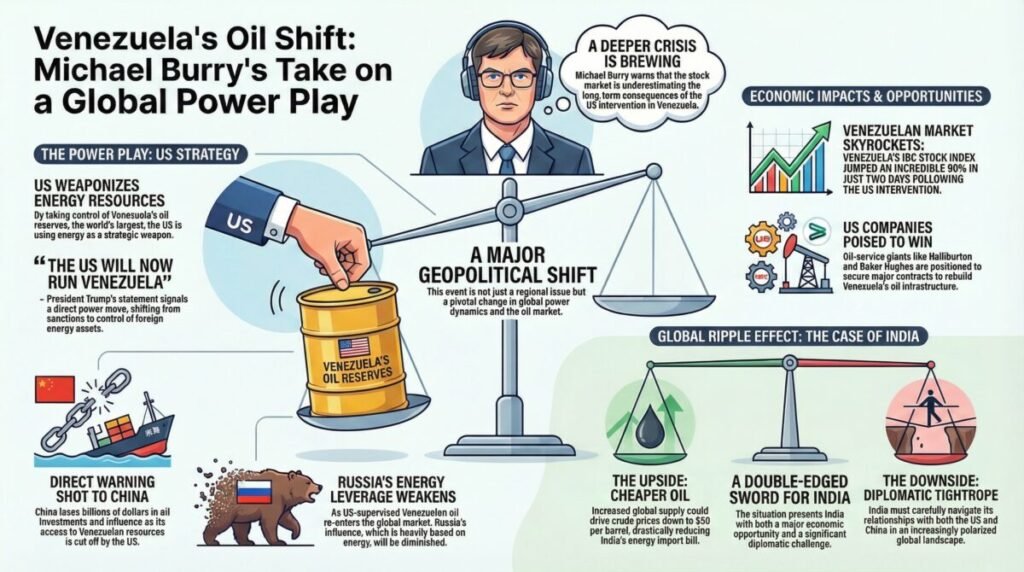

Key Points:

- Michael Burry warns stock market is complacent about Venezuela crisis, deeper crisis brewing

- US control over Venezuela’s oil reserves represents strategic weaponization of energy resources

- Trump’s “America will run Venezuela” statement signals major geopolitical power shift

- China faces direct warning, loses $billions in Venezuelan oil investments to US control

- Russia’s energy leverage weakens as Venezuelan oil returns under US supervision

- Venezuela’s IBC index jumped 90% in two days following US intervention

- US oil-service companies Halliburton and Baker Hughes positioned to benefit from rebuilding Venezuelan infrastructure

- India could see crude oil prices drop to $50 per barrel, reducing import bills significantly

- India must carefully navigate diplomatic balance amid escalating US-China tensions

According to Michael Burry, who famously predicted the 2008 global financial crisis, the stock market is significantly underestimating the implications of recent US actions in Venezuela. Burry says investors are accustomed to seeing immediate effects, but a deeper crisis is brewing beneath this “complacent market”. According to him, this is not merely a regional political event, but a major shift in global power, the oil market, and geopolitics that will have mid- and long-term consequences.

US Strategic Control Over World’s Largest Oil Reserves

Venezuela possesses the world’s largest oil reserves, but years of sanctions have crippled its production. The US’s establishment of direct control there demonstrates that Washington is using energy resources as a strategic weapon. President Donald Trump’s statement that “the US will now run Venezuela” and the potential arrest of Maduro clearly illustrate this power move. This represents a fundamental shift in how the US projects power, moving from economic sanctions to direct control of foreign energy assets.

Direct Warning to China and Russia

Michael Burry believes this development is a direct warning to China. China has invested heavily in Venezuela over the past decade and a half, hoping to benefit from its oil production, which is now under US influence. Similarly, if Venezuelan oil returns to the global market under US supervision, Russia’s energy-based leverage will weaken. According to Burry, the US has accomplished in a short time what Russia failed to do for years, effectively neutralizing Moscow’s influence in the region.

Market Impact and Investment Opportunities

While Venezuela’s IBC index has jumped 90% in two days, US oil-service companies like Halliburton and Baker Hughes could directly benefit from rebuilding the dilapidated oil sector. These companies possess the technical expertise and equipment necessary to restore Venezuela’s production capacity, positioning them for significant contracts under US oversight. The rapid index surge reflects market optimism about renewed oil production, though Burry cautions this may be premature.

Implications for India: Lower Oil Prices vs. Diplomatic Challenges

For India, the good news is that increased global supply could drive crude oil prices down to $50 per barrel, reducing its import bill. However, India will need to manage its diplomatic balance amidst the escalating US-China tensions carefully. As the US consolidates control over Venezuelan oil, India must navigate its relationships with both Washington and Beijing while securing its energy interests in an increasingly polarized global landscape.