Key Points:

- Bankruptcy surge in FY2024: Japan recorded 10,144 bankruptcy filings, a 12% increase from the previous year, marking the highest number since 2013.

- Small and medium-sized enterprises hit hardest: Rising costs and labor shortages drove insolvencies, while total debt fell to ¥2.37 trillion ($16.08 billion).

- Mitsubishi Aircraft Corp leads debt figures: Liquidation of the SpaceJet project accounted for ¥641 billion in liabilities.

- Economic challenges mount: Weak yen, labor shortages, and stricter regulations exacerbate business failures across sectors.

- BOJ monitors closely: Policymakers consider bankruptcy data critical in assessing economic stability amid potential interest rate hikes.

Tokyo: Japan’s fiscal year 2024 saw a sharp rise in corporate bankruptcies, with filings reaching 10,144 the highest in over a decade according to Tokyo Shoko Research (TSR). This 12% increase from FY2023 highlights growing challenges for businesses amid economic uncertainty tied to the Bank of Japan’s (BOJ) interest rate hike schedule and broader global pressures.

Economic Pressures Driving Bankruptcies

The surge in bankruptcies is attributed to multiple factors:

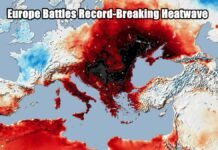

- Weak yen: The Japanese currency plunged to its lowest level in 37 years against the US dollar, driving up import costs for businesses.

- Labor shortages: An aging population and stricter overtime regulations have strained industries such as construction and services.

- Post-pandemic tax measures: The end of special tax deferrals introduced during COVID-19 added financial burdens for small businesses.

Most industries saw increased bankruptcies, except for financial services and transportation. The services sector was hit hardest, with 3,329 cases a 13.2% rise while construction recorded 1,924 bankruptcies due to hiring difficulties.

Debt Trends and Key Cases

Despite the rise in filings, total debt from bankruptcies fell slightly to ¥2.37 trillion ($16.08 billion) from ¥2.46 trillion in FY2023. This decline reflects a higher proportion of small and mid-sized firms going insolvent.

The largest bankruptcy case involved Mitsubishi Aircraft Corp., which was liquidated with ¥641 billion in debt following the termination of its ambitious SpaceJet regional jet project. The SpaceJet program faced prolonged delays and budget cuts before being canceled entirely in February 2023.

Impact on Businesses

The ripple effects of these challenges are evident:

- Inflation-related bankruptcies: Cases linked to rising costs grew for the second consecutive year, totaling 698.

- Labor shortage-related insolvencies: A record 289 cases were reported, nearly doubling from the previous year.

- Succession issues: Businesses unable to find successors accounted for 462 bankruptcies another record high.

While some companies avoided bankruptcy through loan refinancing, analysts warn that many may continue struggling without significant operational improvements.

BOJ’s Role and Future Outlook

Bankruptcy data serves as a critical indicator for BOJ policymakers as they evaluate the health of Japan’s economy. Governor Kazuo Ueda has stated that interest rate hikes will depend on sustained wage increases particularly among smaller firms—that support consumption-led growth.

Analysts predict that while near-term challenges persist, macroeconomic stability and technological advancements like generative AI could drive recovery in late FY2025.

Japan’s record bankruptcy filings underscore the mounting pressures on its economy as businesses grapple with rising costs, regulatory changes, and global uncertainties. Policymakers face tough decisions ahead as they balance rate hikes with measures to stabilize growth.