Key Points:

- RBI Governor Sanjay Malhotra confirms a strong outlook for India’s economy, projecting a 6.5% GDP growth for FY 2025-26.

- US President Trump’s latest 25% tariffs on Indian goods could squeeze exports, but India’s fundamental strength, domestic demand, and policy support should cushion the blow.

- Quarterly growth forecast: Q1 – 6.5%, Q2 – 6.7%, Q3 – 6.6%, Q4 – 6.3% for 2025-26.

- Booming services, construction, and trade sectors are expected to buffer global volatility.

- Inflation stays within the RBI’s comfort zone, and government capital expenditure adds to economic momentum.

- RBI strongly refutes “Dead Economy” jibe, asserting India’s dynamic resilience.

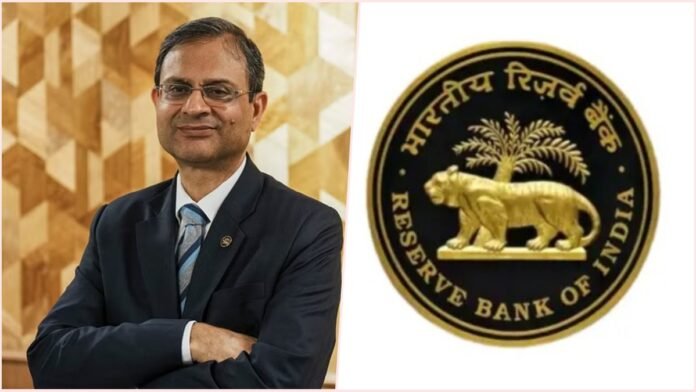

New Delhi: Announcing the latest monetary policy on August 6, RBI Governor Sanjay Malhotra emphatically declared India’s economy “very much alive and robust,” brushing aside recent doubts cast by international disruptions and President Trump’s “dead economy” remark. Malhotra pointed to an estimated 6.5% GDP growth for fiscal year 2025-26, with solid prospects in both rural and urban sectors.

Trump’s Tariff Move Tests Indian Exports

The recent US decision to levy a 25% import duty on Indian products following Trump’s earlier 27% tariff threat in April has amplified concerns for Indian exporters. Governor Malhotra candidly acknowledged that these added costs could render Indian goods less competitive in global markets and squeeze export earnings, especially in sectors like textiles, auto components, and electronics.

However, he assured that India’s diversified economy and sizeable domestic market offer a crucial safety net. “While global instability poses headwinds, India’s internal strength will keep our growth on track,” Malhotra said.

Resilience Drivers: What’s Powering India’s Growth?

Malhotra listed several drivers behind India’s ongoing economic momentum:

- Favorable Monsoon: Good rainfall boosts rural incomes and stabilizes food inflation.

- Controlled Inflation: Consumer Price Index remains within target, supporting purchasing power.

- Industrial & Service Sector Boom: Construction, trade, and IT continue to see robust expansion.

- Government Initiatives: Higher public capex and infrastructure spending are stimulating the economy.

- Balanced Financial System: Sound banking and credit flows encourage private investment.

He emphasized that India’s stable policy framework and increasing digitalization are making the economy both resilient and adaptive to shocks.

GDP Growth Outlook: Steady Climb Projected

The RBI expects India’s quarterly GDP to rise steadily through the year:

- Q1 (April–June): 6.5%

- Q2: 6.7%

- Q3: 6.6%

- Q4: 6.3%

This trajectory, Malhotra said, is a clear signal of India’s enduring potential—even if global trade faces turbulence due to US policy shifts.

India’s Message to the World

Directly countering US President Trump’s “dead economy” claim, Governor Malhotra stated, “India’s economic vitality comes from domestic demand, stable policies, and a young workforce. International skepticism won’t halt our progress.” He reiterated that proactive reforms and healthy macroeconomic indicators position India well to deal with external shocks.

What to Watch in Coming Months

- Exporters may need to seek new global markets or enhance value-addition to offset the hit from US tariffs.

- Investors & Businesses are urged to capitalize on domestic opportunities, especially in infrastructure, services, and manufacturing for the home market.