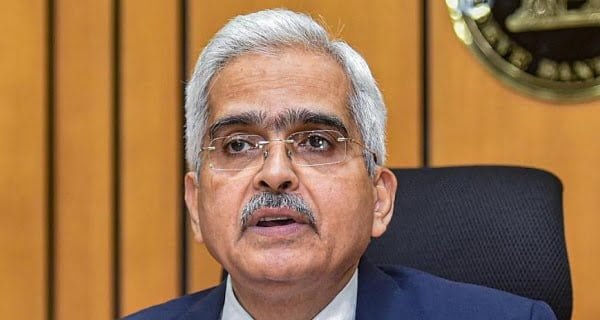

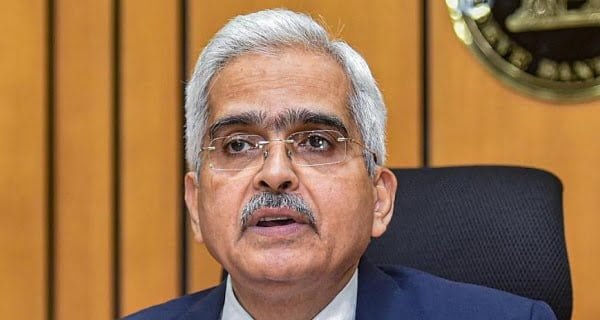

New Delhi: Reserve Bank of India (RBI) Governor Shaktikanta Das has set his sights on expanding the global footprint of Indian fintech solutions, particularly the Unified Payments Interface (UPI) and RuPay. Speaking at the Global Fintech Fest 2024, Das outlined the central bank’s strategic priorities, emphasizing financial inclusion, digital public infrastructure (DPI), consumer protection, cyber security, sustainable finance, and international integration of financial services.

Key Highlights:

- Global Aspirations: Das expressed India’s active engagement in international cooperation and bilateral agreements to foster economic ties with other nations. Strengthening financial infrastructure, including cross-border payment systems, ranks high on the RBI’s agenda. The goal? To position India as a global hub for digital innovation and fintech startups, leveraging its tech talent and evolving ecosystem.

- UPI and RuPay on the World Stage: Governor Das declared, “We are now focusing on making the UPI and the RuPay truly global.” Notable progress has already been made with countries like Bhutan, Nepal, Sri Lanka, Singapore, the UAE, Mauritius, Namibia, Peru, and France accepting RuPay cards and facilitating payments through the UPI network. These collaborative efforts underscore India’s initiatives resonating across the globe.

- Challenges from America: While RBI pushes for global UPI adoption, challenges remain. Christopher J. Waller, a member of the Board of Governors of the Federal Reserve System in America, has questioned the ability of UPI and similar options to deliver fast and cost-effective cross-border transactions. Waller’s skepticism highlights the need for robust interlinking arrangements to meet global payment demands.

- FedNow vs. UPI: The US Federal Reserve’s fast payment network, FedNow Service, is in play. Vasudevan, RBI’s Executive Director, remains hopeful about linking FedNow and UPI, even if it takes time. As the US expands its payment infrastructure, India’s UPI aims to keep pace, bridging the gap between the two economic powerhouses.

- Digital Financial Inclusion: Das emphasized the unique advantages of scalability and cost-effectiveness in digital financial inclusion. The new trinity of JAM-UPI-ULI (Jan Dhan, Aadhaar, Mobile-UPI-Linkage Interface) promises revolutionary strides in India’s digital infrastructure journey.

RBI’s ambitious vision seeks to propel UPI and RuPay onto the global stage, fostering financial cooperation and innovation while overcoming obstacles. As the world watches, India’s fintech revolution continues to gather momentum.

Advertisement