Key Highlights

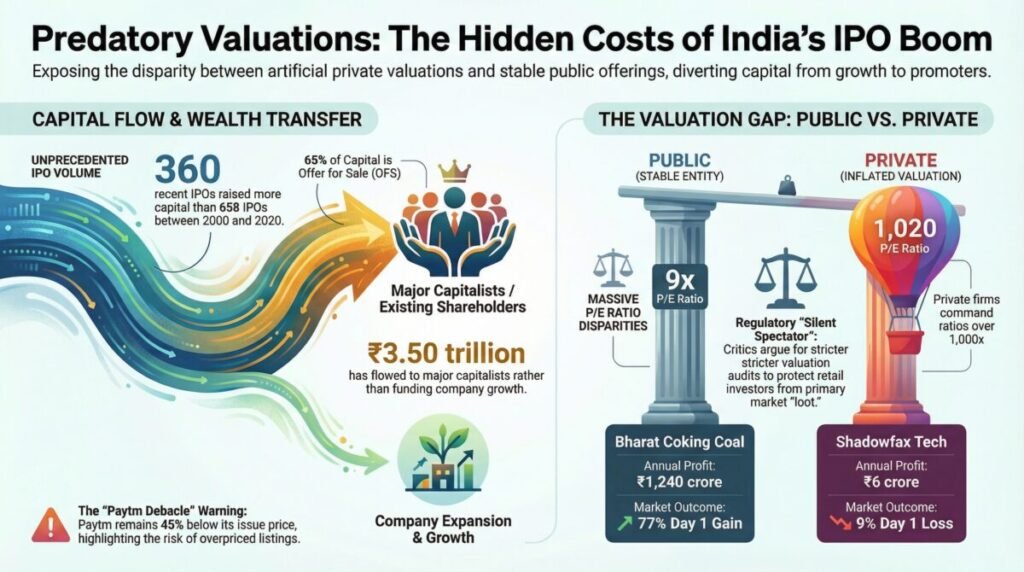

- IPO Overdrive: Capital raised in the last five years has surpassed the total amount collected between 2000 and 2020.

- OFS Dominance: Approximately 65% of recent IPO funds, totaling ₹3.50 trillion, have exited to promoters and foreign investors via Offer for Sale.

- Retail Losses: Nearly 45% of new listings have left retail participants in the red, raising questions about merchant banker valuations.

- Valuation Contrast: The reasonable pricing of PSU firm Bharat Coking Coal (PE 9) stands in stark contrast to private firms like Shadowfax (PE 1,020).

- Regulatory Silence: Critics are calling for SEBI to investigate the “cartel” of speculators allegedly propping up indices to offload expensive shares.

The Indian equity market is witnessing a sophisticated “game” of index management, where the Sensex and Nifty are allegedly kept at artificial highs to facilitate a predatory environment for new listings. Market observers suggest that a “cartel” of speculators and large fund houses is working in tandem to maintain elevated levels, creating a false sense of security for retail investors. This strategy is reportedly used to push expensive Initial Public Offerings (IPOs) at arbitrary prices, potentially derailing the long-term India Growth Story.

The scale of this activity is unprecedented. In the last five years, nearly 360 IPOs have successfully tapped the market, raising more capital than the 658 IPOs did during the entire 20-year period between 2000 and 2020. While these figures suggest a robust economy, a deeper dive into the data reveals a more concerning trend. Of the total capital raised, ₹3.50 trillion, or 65%, consists of Offer for Sale (OFS) transactions. This means a majority of the wealth is not being utilized for company growth but is instead flowing from the pockets of millions of retail investors into those of major capitalists and foreign institutional investors.

A Study in Contrast: Public Strength vs. Private Excess

The recent listings of Bharat Coking Coal and Shadowfax Technologies serve as a perfect case study for the current market disparity. Bharat Coking Coal, a government-owned entity with 50 years of operational history and an annual profit of ₹1,240 crore, launched its ₹1,068 crore IPO in January 2026. The issue was priced at a conservative Price-to-Earnings (PE) ratio of 9, leading to a massive 77% gain for investors on the first day of listing.

Conversely, the ₹1,907 crore IPO of Shadowfax Technologies, a nine-year-old private logistics firm, was launched with a staggering PE ratio of 1,020. Despite an annual profit of just ₹6 crore, the company was priced at ₹124 per share. Predictably, the stock listed at a 9% loss and quickly slid to ₹98. This disparity raises a critical question: how can companies with such marginal profits obtain regulatory approval for exorbitant valuations, while stable, profit-making public firms remain grounded in reality?

The Lingering Shadow of the Paytm Debacle

The current trend mirrors the 2021 Paytm IPO, which remains a sore point for over a million retail investors. Launched at a peak price of ₹2,150 despite heavy losses, Paytm’s stock still trades at approximately ₹1,169, representing a 45% decline from its issue price. Critics argue that while SEBI has taken commendable steps to curb speculative trading in Futures and Options (F&O), where 90% of retail investors lose money, it has remained a silent spectator to the “blind loot” occurring in the primary market.

SEBI Chairman Tuhin Kanta Pandey recently highlighted that India’s market capitalization has quadrupled in the last decade, reaching over ₹470 lakh crore. However, the regulator has yet to conduct a comprehensive study on the billions of rupees lost by retail and mutual fund investors due to overpriced IPOs. As merchant bankers and promoters continue to exercise a “free hand” in setting prices, the call for more stringent valuation audits and regulatory accountability grows louder.