Key Points

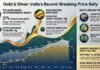

- Gold hits new record of ₹1,15,292 per 10 grams on September 29, 2025, surging ₹2,030 in single day

- Silver rockets to ₹1,44,100 per kg, jumping massive ₹6,000 from previous session

- MCX futures peak at lifetime high of ₹1,14,992 per 10 grams with unprecedented volatility

- Daily gains explosive ranging from ₹1,000-₹6,000 compared to traditional ₹200-300 increases

- Diwali predictions bullish with experts forecasting gold at ₹1,22,000 and silver at ₹1,60,000

- Festival demand surging as buyers rush to secure precious metals before further price escalation

New Delhi: The Indian bullion market witnessed extraordinary volatility on Monday, September 29, 2025, as both gold and silver prices shattered previous records in an unprecedented single-day surge. According to the India Bullion and Jewellers Association (IBJA), 24-carat pure gold crossed the ₹1.15 lakh mark, reaching ₹1,15,292 per 10 grams, representing a staggering increase of ₹2,030 from Friday’s closing price.

The dramatic price movement reflects a fundamental shift in market dynamics, with daily fluctuations now exceeding ₹1,000-2,500 compared to the traditional modest increases of ₹200-300 that characterized previous years. This explosive growth pattern has caught both industry experts and consumers off-guard, fundamentally altering purchasing strategies across the country.

Silver Outpaces Gold in Percentage Gains

Silver demonstrated even more dramatic price action, surging by ₹6,000 in a single session to reach ₹1,44,100 per kilogram. This represents the most significant single-day gain recorded for silver in recent market history, outpacing gold’s percentage increase and surprising commodity analysts who typically expect more stable precious metal movements.

The Multi Commodity Exchange (MCX) gold futures for October delivery jumped ₹1,204 to hit a lifetime high of ₹1,14,992 per 10 grams, confirming the broad-based nature of this price rally across all trading platforms. The futures market’s record-breaking performance indicates sustained institutional and retail buying pressure.

Festival Season Demand Drives Market Frenzy

Industry experts attribute the current price surge to multiple converging factors, with festival season demand playing a crucial role in accelerating the upward momentum. The traditional buying pattern ahead of Dussehra and Diwali celebrations has intensified significantly this year, with consumers rushing to secure purchases before anticipated further price increases.

Regional price variations also emerged, with Chennai recording the highest 24-carat gold rates at ₹1,16,090 per 10 grams, while Mumbai and Kolkata maintained rates of ₹1,15,700 per 10 grams. Delhi prices stood at ₹1,15,850 per 10 grams, reflecting transportation costs and regional demand patterns across major metropolitan centers.

Weekly Price Trajectory Shows Consistent Upward Trend

Recent Gold Price Movement (Per 10 Grams):

- September 23: ₹1,12,000

- September 24: ₹1,14,500

- September 25: ₹1,14,000

- September 26: ₹1,13,800

- September 27: ₹1,14,100

- September 29: ₹1,15,292

Silver Price Evolution (Per Kg):

- September 23: ₹1,32,800

- September 24: ₹1,36,300

- September 25: ₹1,35,700

- September 26: ₹1,38,200

- September 27: ₹1,43,400

- September 29: ₹1,44,100

Expert Predictions Point to Further Escalation

Leading bullion traders express confidence that current price levels represent only the beginning of a more sustained rally extending through the Diwali season. Market analysts project 24-carat gold could reach ₹1,22,000 per 10 grams by Diwali, while silver may touch ₹1,60,000 per kilogram during the same period.

However, experts acknowledge potential volatility from external factors, including international trade policies and central bank monetary decisions, which could introduce temporary corrections of ₹2,000-3,000. Despite these possibilities, the fundamental upward trajectory remains firmly established according to industry consensus.

Investment Advisory and Market Outlook

Bullion traders increasingly recommend immediate purchases, citing the traditional market wisdom that “it’s better to regret buying gold and silver than to regret not buying it”. The current environment combines strong domestic demand with international factors including central bank gold acquisitions and global economic uncertainties.

The dramatic shift from historical price patterns suggests a new paradigm for precious metals investing in India, with daily volatility levels previously associated only with equity markets now characterizing gold and silver trading. This transformation requires updated investment strategies and risk management approaches for both retail consumers and institutional participants.

The convergence of festival season demand, international monetary policies, and structural market changes appears likely to sustain elevated price levels well beyond the current festival period, fundamentally altering the landscape for precious metals investment in India.