Key Points:

- ED attaches 154 flats in Kurla and receivables worth ₹185.84 crore in DHFL bank loan fraud case on September 9, 2025

- Total attached assets now reach ₹256.23 crore after latest action against Wadhawan brothers

- ₹34,615 crore fraud exposed involving consortium of 17 banks led by Union Bank of India

- Share price manipulation scheme uncovered using proxy companies and pre-arranged trades during 2017-18

- Chargesheet already filed in special PMLA court in Mumbai in April 2025; cognizance taken in May

New Delhi: The Enforcement Directorate (ED) has delivered a major blow to the Wadhawan brothers in India’s largest housing finance scam, provisionally attaching 154 flats and movable assets worth ₹185.84 crore in Mumbai’s Kurla area on September 9, 2025. This latest action brings the total value of attached properties in the DHFL case to ₹256.23 crore.

Latest Developments in DHFL Fraud Investigation

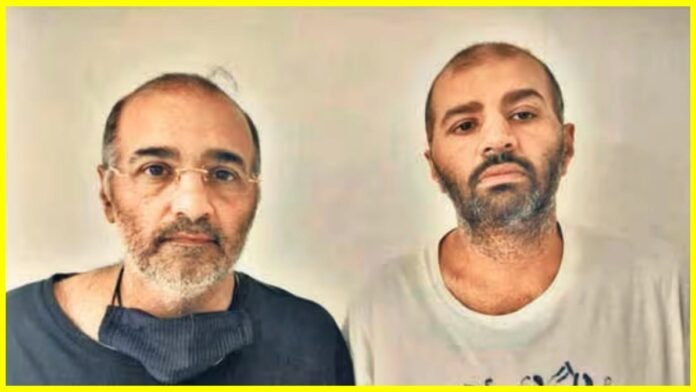

The fresh attachment order, issued by ED’s Mumbai zonal office on September 5, 2025, targets properties belonging to Dewan Housing Finance Corporation Limited (DHFL) and its promoters Kapil Wadhawan and Dheeraj Wadhawan. The attached assets include 154 flats in a Kurla project developed by the siblings and receivables from an additional 20 flats.

This action comes as part of an ongoing money laundering investigation under the Prevention of Money Laundering Act (PMLA), 2002, based on a Central Bureau of Investigation (CBI) FIR registered in June 2022. The case involves allegations that the accused induced a consortium of 17 banks to sanction loans worth ₹42,871 crore but later dishonestly defaulted, causing banks a wrongful loss of ₹34,615 crore.

Sophisticated Share Manipulation Scheme Exposed

ED’s investigation has uncovered a complex web of financial manipulation orchestrated by the Wadhawan brothers during 2017-2018. The probe revealed that Kapil and Dheeraj Wadhawan conspired to divert DHFL funds through proxy companies and inter-corporate deposits (ICDs) for fraudulent trading in DHFL shares.

According to ED officials, these trades were “pre-arranged to rig the share price and volumes of publicly listed DHFL stock” and executed via brokers. In a particularly brazen move, after RBI refused to grant an extension to Yes Bank CEO Rana Kapoor in September 2018 (who had financial links with the Wadhawans), DHFL’s share price fell drastically.

Kapil Wadhawan allegedly diverted ₹115 crore to a broker from their firm disguised as loans through a builder, with instructions to purchase DHFL shares at lower prices for future profit.

Massive Fund Diversion Through Shell Companies

The investigation has exposed the staggering scale of the fraud, with the Wadhawan siblings using 66 entities associated with them to divert ₹24,595 crore from DHFL under the guise of loans. Of this amount, ₹11,909 crore remains outstanding.

Even more shocking is the revelation that DHFL allegedly disbursed ₹14,000 crore in false loans in the names of 1.8 lakh non-existent persons as housing loans. These fraudulent records, referred to as ‘Bandra books,’ later turned into non-performing assets.

Previous Asset Attachments Paint Lavish Lifestyle Picture

This isn’t the first time ED has targeted the Wadhawan brothers’ assets. In October 2023, the agency had previously attached assets worth ₹70.39 crore, including:

- Paintings and sculptures worth ₹28.58 crore

- High-end watches worth ₹5 crore

- Diamond jewelry worth ₹10.71 crore

- 20% stake in a helicopter worth ₹9 crore

- Two luxury flats in Bandra worth ₹17.1 crore

Legal Proceedings and Current Status

The ED has maintained an aggressive prosecution strategy, filing its chargesheet in a special Mumbai PMLA court in April 2025, with cognizance taken on May 2, 2025. The Wadhawan brothers are facing money laundering and bank fraud investigations in multiple cases registered by both ED and the Central Bureau of Investigation.

The case has sent shockwaves through India’s banking and financial sector, as DHFL was once considered a major player in the housing finance industry. The company’s collapse has had far-reaching implications for investors, creditors, and the broader financial ecosystem.

Impact on Banking Sector and Recovery Prospects

Financial sector experts view this latest attachment as crucial for potential recovery efforts. The attachment of 154 flats in Mumbai’s expensive real estate market demonstrates the deep-rooted nature of the scam and provides hope for eventual asset recovery for defrauded banks and investors.

Sources indicate that ED’s focus may now shift to identifying properties in other cities, suggesting the investigation’s scope could expand significantly. The agency has made it clear that this represents just one phase of a comprehensive effort to trace and recover assets linked to one of India’s biggest financial frauds.

The Union Bank of India-led consortium of 17 banks continues to pursue recovery through various legal channels, while the ED’s aggressive asset attachment strategy aims to prevent further dissipation of recoverable assets.