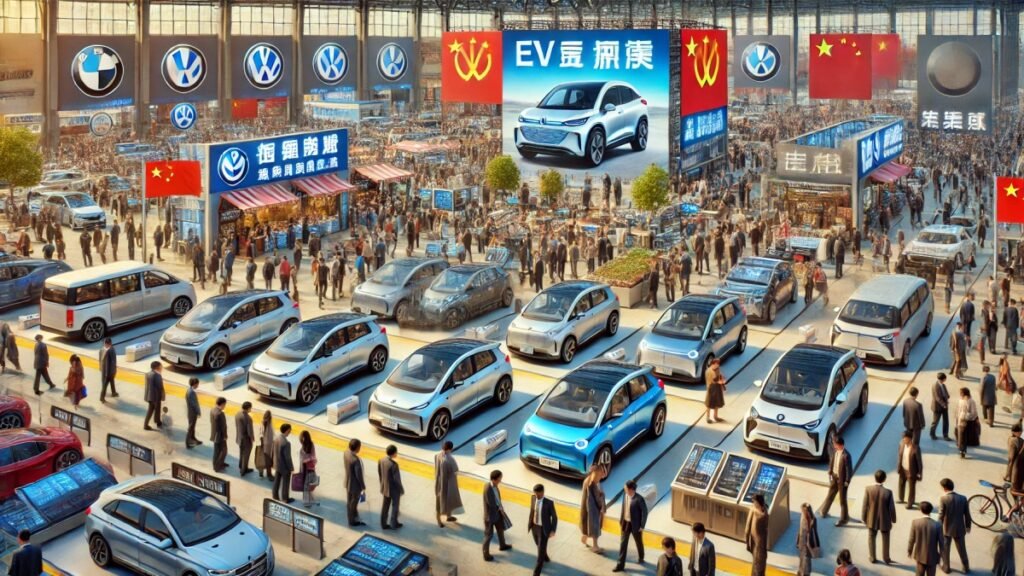

New Delhi: China, the world’s largest automobile market, is rapidly transforming the global auto industry landscape. European carmakers like Volkswagen, Mercedes-Benz, Aston Martin, and BMW are struggling to compete as China’s low-cost electric vehicles (EVs) flood the market, capturing consumers with affordability and government-backed incentives. This influx of competitively priced Chinese EVs has even forced companies like Volkswagen to reduce production and shut down factories in Germany, underscoring the depth of the crisis.

Volkswagen Faces Tough Times as Chinese EV Sales Soar

Volkswagen, once a top seller in China, is now facing a steep decline in its Chinese market performance. After nearly 40 years of steady business, the German carmaker has reported a 10% drop in sales and a drastic 64% decline in profits from its Chinese operations this year. As a result, the company has had to cut back production in China and plans to close three plants in Germany. Volkswagen’s reliance on China, which accounts for over 30% of its income, underscores the severity of the challenges posed by local EV makers.

China’s Strategic Subsidies Fuel the EV Boom

The explosive growth of the Chinese EV industry is fueled by aggressive government support. Backed by substantial subsidies from state banks and government enterprises, Chinese automakers are able to offer EVs at highly competitive prices. These subsidies have enabled local companies to cut costs by about 30%, while EV models are hitting the market at prices up to 50% lower than international competitors.

The scale of China’s auto production is massive: according to the China Association of Automobile Manufacturers (CAAM), over 30 million vehicles were produced in 2023, with 5.2 million of those exported. This level of export growth mirrors the early international expansion of companies like South Korea’s Hyundai in the 1970s.

EVs Dominate China’s Auto Market, Now Cheaper than Petrol Vehicles

More than half of the vehicles sold in China are now electric, a remarkable leap attributed to the long-term strategy China initiated as early as the year 2000. Chinese leaders, recognizing that they could not easily rival Western automakers in traditional petrol vehicles, opted instead to pioneer in the EV sector. A former auto engineer, Wan Gang, who later became a minister, spearheaded this push in 2009, allocating over ₹2.5 lakh crore ($34 billion) in subsidies to EV manufacturers. Today, China sells over 50% of the world’s EVs, making it a formidable player in the industry.

The impact of China’s EV-focused policy has been substantial. According to JATO Dynamics, the cost of electric cars in China is now 19% lower than comparable petrol vehicles, with EVs making up about 20% of total vehicle sales. While Europe has around 50 major car brands and the U.S. and Japan each have around 14, China boasts over 140 brands, with production capacity that outpaces Western manufacturers by nearly 30%.

Global Impact: European Automakers Struggle as Chinese EVs Expand Worldwide

As China’s affordable EVs begin penetrating international markets, the pressure on traditional automakers is intensifying. European and American companies face increasing challenges in sustaining their market share, especially in light of China’s aggressive production and export strategies. The scale and speed of China’s auto industry expansion are reshaping the global market, posing a direct threat to established car manufacturers worldwide.

This upheaval could redefine the automotive industry as we know it, with China emerging not just as a market leader but as a dominant force in both production and export of EVs worldwide.