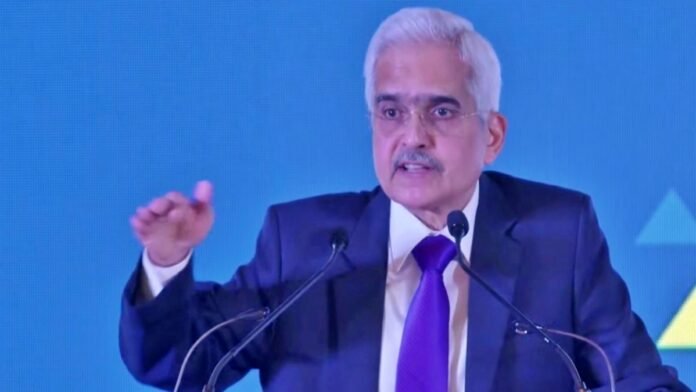

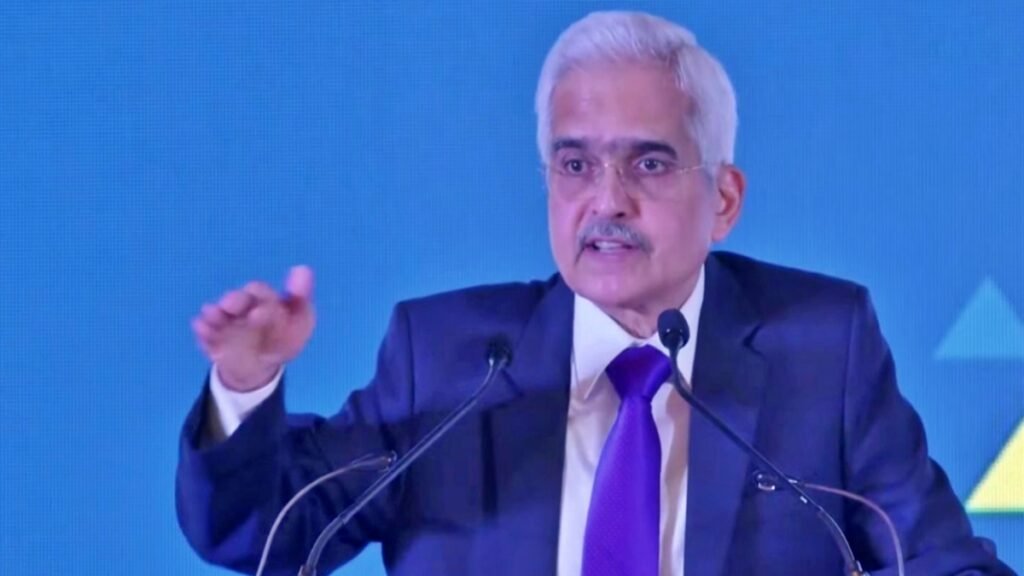

Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday said that the domestic economy and the financial sector are stable and the worst phase of inflation is behind. He added that this is despite several shocks to the global economy from the pandemic, the Ukraine war, and tight monetary policy around the world. He also said that the rupee has exhibited the least volatility against other currencies despite the strong dollar strengthening.

Delivering the 17th KP Hormis (Founder of Federal Bank) Memorial Lecture in Kochi, Das said that despite extreme concerns about the global recession a few months back, the global economy has shown more resilience. The governor said that there is a declining trend in global growth. There is also considerable uncertainty about structural changes in the drivers of inflation. These range from labor market dynamics to the concentration of market power and less efficient supply chains.

However, there were also confidence-building factors, such as global food, energy, and other commodity prices declining from their upper levels, he added. Also, the supply chain is getting back to normal. In such a situation, imported inflation should be under control. On India’s role in handling several emerging crises amid the G20 chairmanship, Das said the country has been given the role at a time when geo-economic changes have been very difficult, which have distorted the global macroeconomic outlook.

He said there is a serious supply-demand imbalance in key sectors and inflation is rising rapidly in almost all countries. This has presented complex policy challenges. He said that the current crisis is an opportunity for the G20 as well as a time of examination.

Das, citing the IMF, said that with the Ukraine war, geopolitics has now been replaced by geoeconomics. Due to this, the global economy is now facing a process of geo-economic fragmentation. This is done through five major mediums – Trade is taking place through technology, capital flows, labor mobility, and global governance.