New Delhi: Petrol-diesel prices remained stagnant for four and a half months and after that on Wednesday, it was increased by 80 paise per liter for the second consecutive day. According to the price notification of fuel retailers, the price of petrol in Delhi will now be ₹ 97.01 per liter instead of ₹ 96.21. Earlier the rate of diesel was Rs 87.47 per liter, which has now increased to Rs 88.27. The price of petrol in Mumbai has increased by 85 paise to Rs 111.67, while in Chennai the price has increased by 75 paise to Rs 102.91. Rates in Kolkata increased from ₹105.51 to ₹106.34.

Diesel prices in Mumbai were increased by 85 paise per liter. It was increased by 80 paise per liter on 22 March after a gap of record 137 days. In states like Uttar Pradesh and Punjab, the prices were stable since November 4, ahead of the assembly elections. During this period, the price of crude oil increased by $ 30 per barrel.

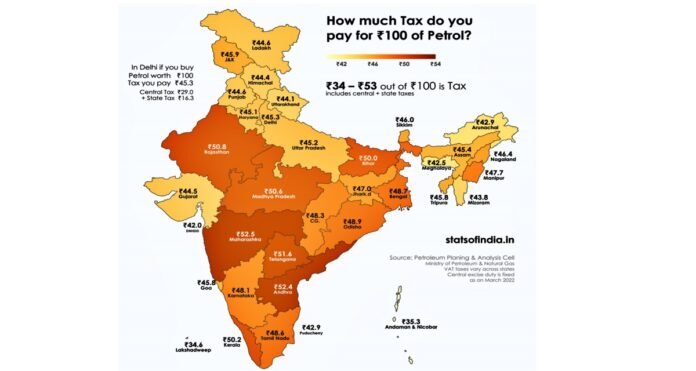

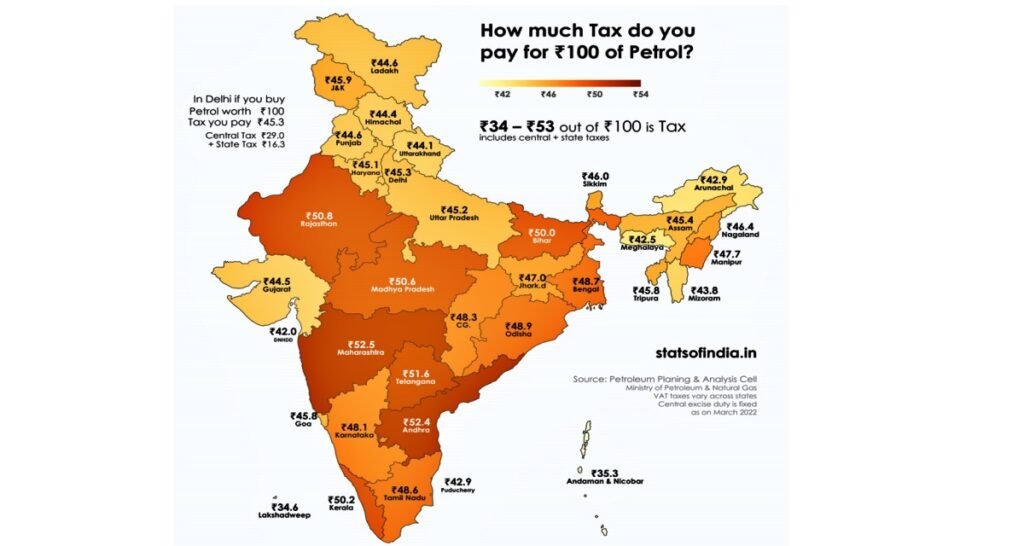

Since the local tax of every state is different, the rates are also different in different states. Take a look at the different rates of tax levied by the states-

How much tax in which state

According to the data of the Petroleum Planning and Analysis Cell under the Ministry of Petroleum, for ₹100 worth of petrol in Delhi, the customer pays ₹45.3, which includes ₹29 central tax and ₹16.3 state tax. Tax is included.

This information has been posted by a Twitter handle named “Stats of India”. Similarly, in Maharashtra, for every ₹100 petrol, people have to pay almost half of this tax.

According to the State of India data, the seven states are Maharashtra (₹52.5), Andhra Pradesh (₹52.4), Telangana (₹51.6), Rajasthan (₹50.8), Madhya Pradesh (₹50.6), Kerala (₹50.2), and Bihar. (₹50) half the price of petrol is charged as tax. In three states, Maharashtra, Andhra Pradesh, and Telangana, state taxes are higher than central excise tax.