Key Points:

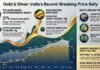

- Gold surged ₹2,650 per 10 grams in Delhi, reaching ₹1,40,850

- 99.9% pure gold closed at ₹1,38,200 on Monday, per All India Bullion Association

- Silver prices neared ₹2.25 lakh amid strong global market trends

- Prices rose for second consecutive day due to international factors

- Experts predict gold could cross ₹1.5 lakh in January 2026

- Spot prices in Delhi bullion market hit new peak

Gold and silver prices continued their relentless upward march on Tuesday, with the yellow metal breaching the psychological ₹1.40 lakh per 10 grams barrier for the first time in Indian market history. The surge, driven by a confluence of global factors and domestic currency weakness, has reignited the bullion rally that began in early December, leaving investors and consumers scrambling to adjust their strategies.

In the Delhi bullion market, the spot price of gold surged by ₹2,650 per 10 grams, marking the second consecutive day of strong gains. The precious metal reached a new lifetime high of ₹1,40,850 per 10 grams, according to the All India Bullion Association. The price of 99.9 percent pure gold had closed at ₹1,38,200 per 10 grams on Monday, meaning the two-day gain alone amounts to over ₹4,500 per 10 grams.

Global Factors Fueling the Rally

The unprecedented price surge stems primarily from robust trends in international markets, where gold futures on COMEX touched $2,150 per ounce, their highest level since March 2024. Market analysts attribute this strength to multiple factors, including the US Federal Reserve’s dovish stance on interest rates, escalating geopolitical tensions in the Middle East, and persistent buying by central banks, particularly China and Russia.

The weakening Indian rupee, which slipped below 84.50 against the US dollar, has amplified the impact of global price increases. Since gold is denominated in dollars, any rupee depreciation makes imports more expensive, directly translating into higher domestic prices. The rupee has lost nearly 2.5% against the dollar in the past month alone, adding approximately ₹3,500 to the landed cost of gold per 10 grams.

Silver Joins the Rally, Approaches ₹2.25 Lakh

Silver has outpaced gold in percentage terms, with spot prices in the Delhi market reaching close to ₹2.25 lakh per kilogram, up by ₹4,800 from Monday’s close. The white metal’s industrial demand, particularly from the solar panel manufacturing sector, combined with its traditional role as a precious metal hedge, has created a perfect storm for price appreciation.

MCX silver futures for March delivery hit ₹2,23,450 per kilogram during intraday trading, reflecting a 2.2% single-day gain. Traders report heavy short-covering in silver futures, as speculators who bet on price corrections scramble to close their positions amid the relentless upward momentum.

Investment Demand Surges, Jewelry Market Stunned

The price surge has triggered panic buying among investors fearing further increases, while simultaneously dampening physical demand in the jewelry sector. Gold ETFs saw net inflows of ₹847 crore on Monday, the highest single-day figure since Diwali 2025. Digital gold platforms reported a 300% spike in transaction volumes, with many investors buying fractional gold to avoid the high absolute cost.

However, the jewelry trade faces a crisis. “Retail footfall has dropped by 60% in the past week,” said Ashok Minawala, former chairman of the All India Gem and Jewellery Domestic Council. “Brides and wedding parties are either postponing purchases or switching to lower-carat jewelry. Many jewelers are offering 0% EMI schemes to maintain some sales volume.”

Expert Predictions: ₹1.5 Lakh in Sight

Market veterans believe the rally has further room to run. “With gold and silver prices rising at such a rapid pace, there is no doubt that they could cross the ₹1.5 lakh mark in the very first month of the new year,” said Prithviraj Kothari, former president of the India Bullion and Jewellers Association. He cites the upcoming US debt ceiling debate, potential rate cuts by the European Central Bank, and continued central bank buying as catalysts for further gains.

Technical analysts point to strong support at ₹1,38,000 and resistance at ₹1,42,000. A breakout above this level could trigger momentum buying, pushing prices toward the ₹1.45 lakh mark by mid-January. The relative strength index (RSI) for gold futures stands at 71, indicating overbought conditions but not yet at extreme levels that would signal an immediate correction.

Historical Context and Future Outlook

Today’s price of ₹1,40,850 represents a 28% increase from January 2025, when gold traded around ₹1,10,000 per 10 grams. The surge has outperformed most equity indices and fixed-income instruments, validating gold’s role as a portfolio diversifier. For context, gold was trading at ₹50,000 per 10 grams just five years ago, meaning it has nearly tripled in half a decade.

Looking ahead, the trajectory depends on multiple variables. If the Fed cuts rates aggressively in 2026, gold could test ₹1.55 lakh by March. Conversely, a stronger-than-expected US jobs report or a sudden rupee appreciation could trigger a 3-5% correction. However, most bullion dealers agree that the long-term trend remains firmly bullish, supported by structural demand from Asian markets and limited new mine supply.

What Should Investors Do?

Financial advisors recommend a balanced approach. “Don’t chase prices at these levels. “If you’re a long-term investor, allocate 10-15% of your portfolio to gold through SIPs in gold ETFs. For immediate buyers, consider waiting for a dip to ₹1,37,000-1,38,000 levels.”

For those who must buy now, jewelers suggest considering 18-carat gold instead of 22-carat, or exploring gold-saving schemes that allow installment purchases. The government’s Sovereign Gold Bonds, offering 2.5% annual interest plus capital appreciation, remain an attractive alternative to physical gold, though they come with a 5-year lock-in period.