Key Points

- Silver reached ₹200,887 per kg, up nearly ₹1,600, marking a 100% surge in 2025

- Gold hit record high of ₹134,966 per 10 grams, rising nearly ₹2,500 on MCX

- Industrial demand from solar energy, electric vehicles, and semiconductors driving silver’s rally

- Geopolitical tensions, US tariff concerns, and central bank purchases supporting precious metals

- Indian stock markets also gained, with Nifty closing above 26,000 and Sensex at 85,267

- Experts advise ETF investments for those unable to afford physical purchases at current levels

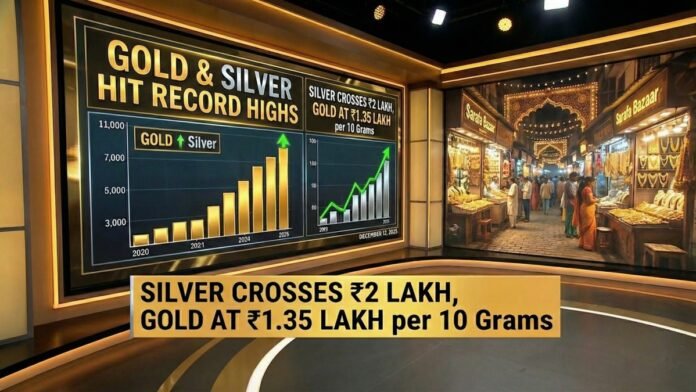

Precious metals have delivered astonishing returns in 2025, with silver leading the charge by doubling in value. On the Multi-Commodity Exchange (MCX), silver futures surged to ₹200,887 per kg, registering a single-day gain of nearly ₹1,600. This milestone marks the first time in Indian commodity market history that silver has breached the psychological ₹2 lakh per kg barrier, capping a remarkable year-long rally that has seen prices rise over 100% since January.

Gold has been no laggard either, climbing nearly ₹2,500 during evening trade to reach ₹134,966 per 10 grams, establishing a new all-time high. The yellow metal’s ascent has been more measured but equally impressive, with year-to-date gains exceeding 35%. The sharp jump in both metals occurred after Indian stock market hours, providing a late-session surprise for commodity traders and investors who had positioned themselves for continued upward momentum.

Industrial Demand Powers Silver’s Meteoric Rise

The primary driver behind silver’s exceptional performance is the explosive growth in industrial applications. According to a detailed report by Axis Mutual Fund, the continued expansion of solar energy installations, electric vehicle manufacturing, and semiconductor production has created unprecedented demand for silver’s conductive properties. The metal’s unique combination of thermal and electrical conductivity makes it irreplaceable in photovoltaic cells, EV charging infrastructure, and advanced electronics.

Experts explained that encouraging industrial production trends and a weakening US dollar have created a perfect storm for silver prices. “This momentum remains positive with expectations of increased demand from industry and clean energy sectors,” Kamboj stated, adding that silver could see further upside in the coming months as manufacturing capacity expands globally.

Multiple Catalysts Fueling the Rally

Several macroeconomic factors have converged to drive precious metals higher. The Federal Reserve’s interest rate cuts have reduced the opportunity cost of holding non-yielding assets like gold and silver, making them more attractive to institutional and retail investors. Geopolitical tensions in Eastern Europe and the Middle East have heightened safe-haven demand, while concerns about the economic impact of US tariff policies have prompted investors to seek wealth preservation instruments.

Central banks worldwide have been heavy purchasers of gold, with net buying reaching record levels in 2025. Data from the World Gold Council shows that central banks added approximately 1,200 tonnes to their reserves in the first three quarters alone, with emerging market banks leading the acquisitions. This official sector demand provides a strong floor for gold prices and signals a shift away from dollar dominance in international reserves.

Exchange-traded funds (ETFs) have also seen significant inflows, with precious metals ETFs attracting over $15 billion in new investments this year. The combination of institutional buying, retail participation through ETFs, and strong physical demand from Asian markets has created a self-reinforcing upward cycle for both metals.

Stock Market Performance and Correlation

The Indian stock market demonstrated robust performance alongside the commodity rally, with the Nifty 50 index rising 140 points to close above the 26,000 mark, while the Sensex jumped 450 points to finish at 85,267. This simultaneous strength in equities and precious metals reflects abundant liquidity in the financial system and investor confidence in India’s economic growth trajectory.

Market analysts note that while precious metals and equities typically show inverse correlation, the current environment of ample global liquidity and moderate inflation has supported both asset classes. The Indian rupee’s relative stability against the dollar has also helped domestic investors benefit from international price movements in commodities.

Expert Investment Advice and Risk Assessment

Historically, gold and silver have consistently shown upward momentum over the long term, delivering compound annual returns of 12-15% over the past two decades. This track record makes them attractive for portfolio diversification and wealth preservation. However, experts caution that with prices at record highs, short-term risks have increased significantly.

Potential downside factors include weak physical demand at elevated price levels, especially in traditional markets like India and China, where consumers are price-sensitive. Profit-booking by institutional investors who have seen substantial gains could trigger corrections, while potential ETF outflows might accelerate downward moves. Seasonal patterns also suggest that prices could face headwinds in the first quarter of 2026 as demand typically softens after the festive season.

Strategic Investment Recommendations

For investors who find current prices prohibitive for physical purchases, financial experts recommend systematic investment in gold and silver ETFs. This approach offers several advantages, lower entry costs, no storage concerns, high liquidity, and the ability to invest small amounts regularly. By investing a fixed sum monthly, investors can benefit from rupee-cost averaging, which reduces the risk of short-term losses even if prices decline after initial purchase.

Veteran commodity analyst Rakesh Rathod suggests that investors should allocate 10-15% of their portfolio to precious metals, with a 60-40 split between gold and silver. “Gold provides stability and acts as insurance, while silver offers higher growth potential due to industrial demand,” Rathod explained. He advises buying on dips rather than chasing momentum at record highs, and recommends accumulating gradually over the next three to six months.

Outlook for 2026

Looking ahead, most analysts maintain a constructive view on precious metals, though they expect volatility to increase. The continuation of loose monetary policies by major central banks, ongoing geopolitical uncertainties, and structural deficits in silver supply due to mining challenges should provide underlying support. However, investors should prepare for potential corrections of 5-10% as markets digest the rapid gains of 2025.

The consensus view suggests that gold could test ₹140,000 per 10 grams in the first half of 2026, while silver might target ₹220,000 per kg if industrial demand remains robust. However, these projections depend on Federal Reserve policy trajectory, dollar strength, and global economic growth maintaining its current momentum.