Key Highlights

- Status Quo on Rates: Repo rate held steady at 5.25%, with the Standing Deposit Facility (SDF) at 5% and Marginal Standing Facility (MSF) at 5.50%.

- Growth Outlook Raised: The RBI increased the FY2025, 26 real GDP growth forecast to 7.4%, up from the previous estimate of 7.3%.

- Inflation Management: Retail inflation for the current fiscal is projected at 2.1%, though the Q4 forecast was revised slightly upward to 3.2%.

- Trade Boost: Recent trade agreements with the European Union and an upcoming deal with the United States are expected to significantly bolster Indian exports.

- New Base Year: A fresh statistical lens is imminent, with a new base year for GDP and inflation series expected within the next 48 hours.

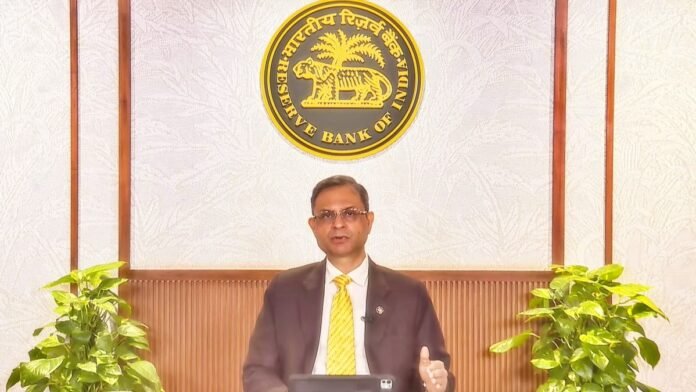

In its sixth and final bi-monthly monetary policy meeting for the 2025, 26 financial year, the Reserve Bank of India’s Monetary Policy Committee (MPC) opted for a cautious pause. Governor Sanjay Malhotra, leading the six-member panel, announced that the repo rate will remain at 5.25%. This decision follows a cumulative 125 basis point reduction in rates throughout 2025, suggesting that the central bank is now focused on the full transmission of those cuts into the broader economy.

While the decision means bank loan interest rates will likely remain unchanged for now, providing no immediate relief to borrowers, the RBI emphasized that the “neutral” stance provides the flexibility to respond to evolving global and domestic conditions.

Economic Resilience and GDP Upgrades

The central bank expressed high confidence in the domestic economy, describing it as being in a “goldilocks” zone of strong growth and manageable inflation. Citing resilient domestic demand and a revival in manufacturing activity, the RBI raised its real GDP growth projection for FY26 to 7.4%.

Governor Malhotra noted that high-frequency indicators suggest that the growth momentum will sustain into the next fiscal year. Projections for the first half of FY2026, 27 have also been adjusted upward, with Q1 and Q2 growth now expected at 6.9% and 7.0%, respectively. This optimism is further supported by healthy corporate balance sheets and a sustained thrust on capital expenditure by the government.

Inflation Dynamics and External Headwinds

On the inflation front, the RBI remains watchful. While the overall CPI inflation for FY26 is projected at a benign 2.1%, the committee raised the forecast for the January, March 2026 quarter to 3.2%, up from 2.9% previously. This adjustment is largely attributed to unfavorable base effects and a rise in the prices of precious metals like gold and silver, rather than a broad-based spike in daily essentials.

The Governor also highlighted that while external headwinds have intensified due to global geopolitical tensions and shifting trade patterns, India’s external sector remains strong. Forex reserves were recorded at a healthy $723.8 billion at the end of January, providing a robust cushion against international volatility.

Trade Deals to Anchor Future Growth

A significant point of discussion during the policy announcement was the role of international trade. The RBI highlighted that the landmark comprehensive trade pact with the European Union, along with prospective deals with the United States, New Zealand, and Oman, will diversify India’s export basket.

Governor Malhotra stated that these agreements, coupled with measures announced in the Union Budget 2026, will strengthen Indian services and merchandise exports over the medium term. Furthermore, the central bank announced plans to allow banks to lend to Real Estate Investment Trusts (REITs) with specific safeguards, aiming to further deepen the domestic financial markets.