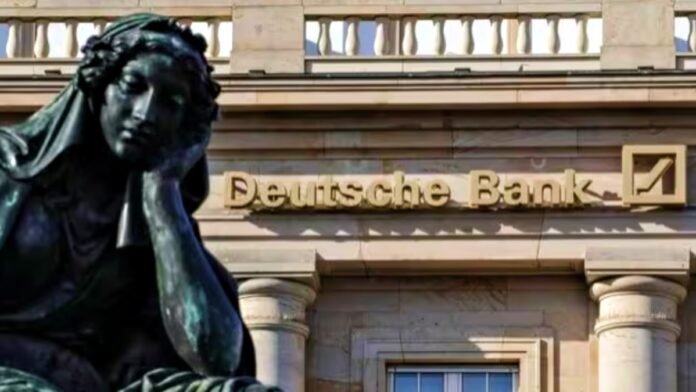

New Delhi: After the news of the sinking of 2 big banks in America, now the banking crisis is increasing in Europe as well. Another bank in Europe is on the verge of credit default. After Credit Suisse, Deutsche Bank increased the tension between investors and depositors. Due to this news, there was a huge decline in the shares of Deutsche Bank. In fact, the bank’s credit default rate has increased to a 4-year high.

Due to this bad news about Deutsche Bank, its shares fell by more than 20 percent in 2 days. The stock of this bank fell by more than 14 percent on March 24 due to an increase in credit default swaps, while on March 25 it saw a decline of 6.5 percent. Deutsche is Germany’s largest bank and its troubled situation could lead to the collapse of the banking system in Europe.

German Chancellor assures investors

Germany’s Chancellor Olaf Scholz has said that the banking system in Europe is completely safe and investors need not panic. Since Deutsche Bank is the largest bank in Germany, it plays an important role in the country’s economy. Apart from Germany, it also has branches in many other countries. This bank is considered one of the safest banks in the world. Deutsche Bank gives loans to most corporate giants. The total assets of the bank have been estimated at $1.4 trillion.

Major changes in leadership to avoid a banking crisis

Investors have been eyeing Deutsche Bank for a long time. It is believed that the way Credit Suisse Bank is trapped in the crisis, in the same way, the situation of Deutsche Bank is being created. In view of these circumstances, major changes have taken place at the level of leadership in the bank in the last few years so that the bank can be saved from any kind of crisis.

Let us tell you that earlier the news of the sinking of Silicon Valley Bank and Signature Bank in America created a stir in the banking sector and stock market around the world. After this came the news of the sinking of Credit Suisse Bank of Switzerland. Now due to the increase of credit default swaps in Deutsche Bank, the clouds of the banking crisis have started looming badly in Europe and America.