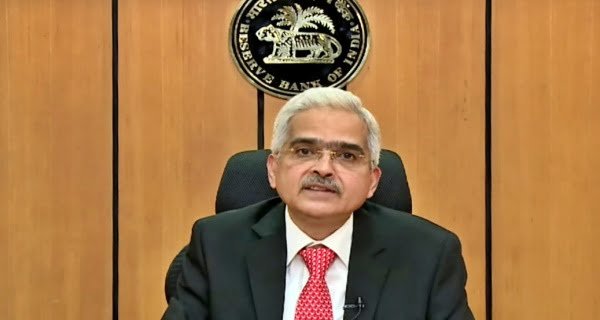

New Delhi: RBI Governor Shaktikanta Das told after the end of the MPC meeting today that the repo rate is being increased by 25 basis points or 0.25 percent. RBI has increased the repo rate for the sixth time in a row. After this, taking a further loan will become more expensive. 4 out of 6 people of the Monetary Policy Committee (MPC) had agreed in favor of increasing the repo rate. According to Das, the inflation rate is estimated to be above 4 percent in FY24. He said that the effect of the increase in interest rates issued from May 2022 is slowly showing its effect.

He said that the Consumer Price Index (CPI) based inflation rate is expected to be 5.6 percent in January-March 2023, while it was 5.9 percent at the same time last year. Regarding the growth of GDP, he said that India’s growth rate is estimated to be 6.4 percent in the financial year 2023-24. According to Das, it will increase from 7.1 percent to 7.8 percent in April-June 2023 as compared to the same period last year. Apart from this, it is estimated to grow at 6.2 percent in July-September against 5.9 percent, 6 percent in October-December, and 5.8 percent in January-March 2024.

Dearness

Shaktikanta Das has said that the estimate of CPI-based inflation for FY23 has been reduced from 6.7 percent to 6.5 percent. At the same time, it is expected to come down to 5.3 percent in the next financial year. He said that due to good yield in Rabi season, inflation in food items will come down. The RBI governor said that due to some unexpected developments in the last year, monetary policy has brought challenging times.

Global economy is better than ever

Shaktikanta Das has said that the global economy is not looking as bad as it was a few months back. He has said that the prospects of growth in the main economies are better than before. According to Das, the inflation rate is also under control, but still it remains above the target in many countries. He said that the Indian rupee remained the least volatile in 2022 as compared to other Asian currencies. It still looks to be in better condition than the rest.

How much impact on home loan

After increasing the repo rate by 0.25 percent, banks will also increase the interest rates of loans linked to external benchmarks by the same amount. This means that your home loan will also become costlier by 25 basis points. The country’s largest public sector bank SBI is currently offering home loans at an initial interest rate of 8.90 percent. After the latest increase, the interest on a home loan of the bank will increase to 9.15 percent.

Now suppose that you have taken a loan of Rs 30 lakh from SBI for 20 years at an interest rate of 8.90 percent. At this rate of interest, now you are paying an EMI of Rs 26,799 every month. In this way, you will pay a total of Rs 34,31,794 as interest in the entire tenure. If your interest increases to 9.15 percent, then the EMI will also increase to Rs 27,282 from the next month. In this way, the burden of Rs 483 will increase on you every month and you will have to pay Rs 5,796 more in a year. Not only this, you will now have to pay Rs 35,47,648 as interest in the entire tenure, which means that the interest burden will also increase by Rs 1,15,854.

How much effect on auto loan

SBI is currently offering auto loans at an initial interest rate of 8.90 percent. If you have taken a loan of Rs 10 lakh for 5 years at the same interest rate, then now the EMI will be Rs 20,276 every month. If there is an increase of 0.25 percent, then the effective interest rate will be 9.15 percent. On this, an EMI of Rs 20,831 will be made from the next month. That means the burden of Rs 555 will increase on you every month. If you see this throughout the year, you will have to pay Rs 6,660 more.