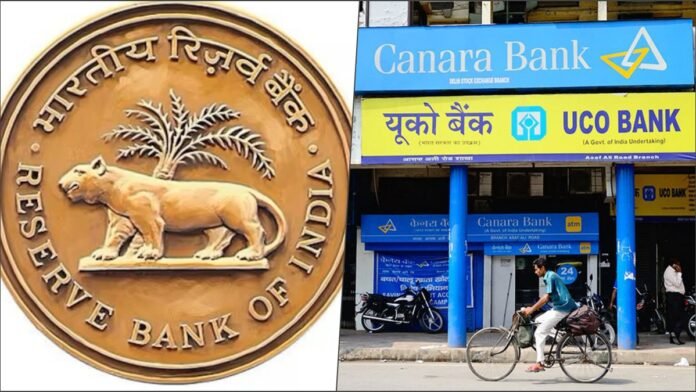

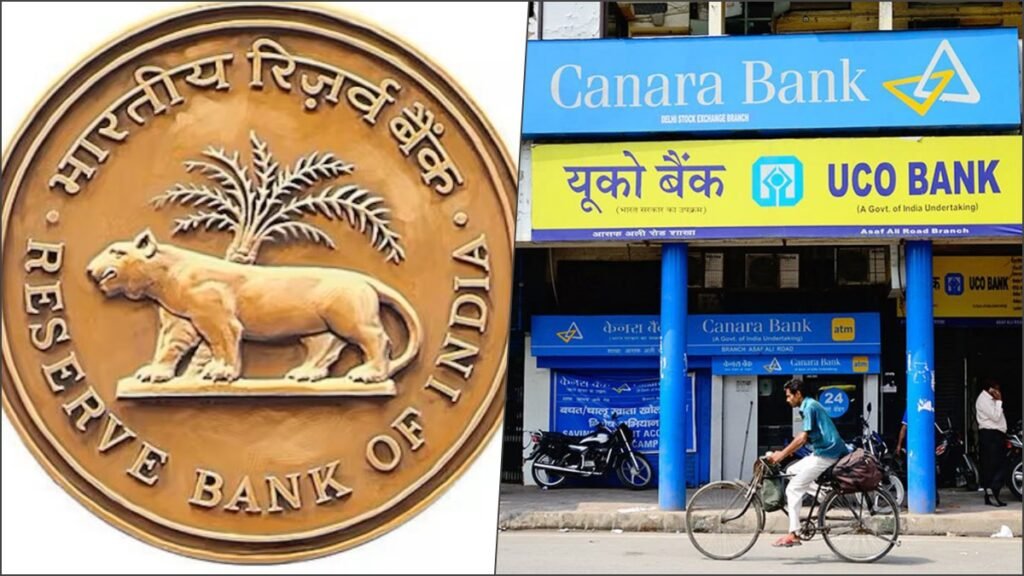

New Delhi: The Reserve Bank of India (RBI) has taken significant action against public sector lender UCO Bank, imposing a hefty fine of ₹2.68 crore for multiple regulatory breaches. This penalty comes as a result of UCO Bank’s failure to comply with the Banking Regulation Act of 1949 and various RBI directives.

Key Violations and Penalty Details

According to an official press release from the RBI, the fine was levied due to UCO Bank’s non-compliance with several critical provisions, including:

- Section 26A of the Banking Regulation Act, 1949: This section pertains to the maintenance of records and reporting requirements.

- Interest Rates on Advances and Deposits: UCO Bank failed to adhere to the prescribed interest rates on both advances and deposits.

- Current Account Discipline: The bank did not maintain proper discipline in managing current accounts.

- Fraud Classification and Reporting: There were lapses in the classification and reporting of fraud cases, as per RBI guidelines.

The RBI’s action follows a supervisory investigation, which led to the issuance of a show-cause notice to UCO Bank. The bank was asked to explain why the maximum penalty should not be imposed. After reviewing the bank’s response, the RBI concluded that a monetary penalty was warranted.

Specific Breaches by UCO Bank

The RBI highlighted several specific areas where UCO Bank fell short:

- Benchmarking Loans: The bank failed to benchmark floating-rate personal retail loans and loans to Micro, Small, and Medium Enterprises (MSMEs) with external benchmarks.

- Current Accounts: UCO Bank opened current accounts for entities with banking system exposure exceeding ₹5 crore, violating regulatory norms.

- Savings Accounts: Savings deposit accounts were opened for ineligible individuals.

- Unclaimed Fixed Deposits: The bank did not transfer unclaimed fixed deposit balances to the Depositors Education and Awareness Fund within the stipulated three-month period, resulting in some balances remaining unclaimed for over ten years.

- Fraud Reporting: There was a lack of diligence in reporting fraud cases to enforcement agencies.

RBI’s Stance

The RBI clarified that this action is based on deficiencies in statutory and regulatory compliance and is not intended to impact any transactions or agreements made by UCO Bank with its customers. The central bank emphasized that the monetary penalty would not adversely affect any other actions initiated against the bank.

This stringent measure underscores the RBI’s commitment to maintaining regulatory discipline and ensuring that banks adhere to established norms to safeguard the integrity of the financial system.