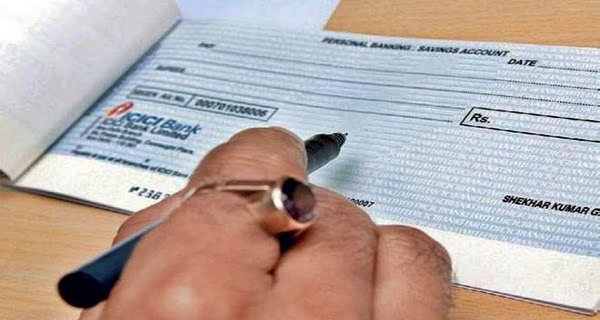

New Delhi: If you are paying through cheque, then you have to be more cautious than before. The Reserve Bank of India (RBI) has made some changes in the banking rules. The central bank has now decided to provide the clock bulk clearing facility, which is going to have a direct impact on the way you pay your cheque. That is, now it will not take 2 days for the check to be cleared. Now after entering the check, its amount will be cleared immediately. In such a situation, you have to be careful while issuing the check and before issuing the check, you have to see whether there is money in your account or not.

Checks will be clear on all seven days – Now check NACH will be available on all seven days, so you have to be more careful before making payment through cheque. Now it will also work on non-working days i.e. weekly holidays and national holidays. So now before issuing the check, check whether there is money in the account or not. Otherwise, the check will bounce. If the check bounces, you will have to pay the penalty from the account.

Know what is NACH – The work of bulk payment is done through NACH operated by the National Payments Corporation of India (NPCI). It allows multiple credit transfers at one time. Apart from this, payment of bulk payments like salary, pension, interest, dividend, etc. is done. It also does the work of payment of electricity, gas, telephone, water, loan installment, investment, insurance premium, etc.

These rules will now be for high-value check payment – RBI implemented the positive pay system in January to make check-based transactions more secure than before. In the Positive Pay system, the details are re-checked for check payments above Rs 50,000.

All details will be rechecked – Under this process, the check issuer electronically gives information from the check presented for clearing. Such as check number, date of the check, name of the payee, account number, amount and other details, etc. The issuer also gets the details of the checks issued earlier.