New Delhi: The Central Board of Direct Taxes (CBDT) on Monday announced a one-time exemption in the verification of pending e-file tax returns (ITR Verification) between assessment year 2015-16 to 2019-20. CBDT has given this relief due to the non-filling of ITR-V. CBDT said that due to non-receipt of valid receipt of ITR-V from taxpayers, pending income tax returns filed through e-filing on a large scale are lying with the Income Tax Department. Actually, this problem has arisen due to lockdown in view of Coronavirus.

Chance till september

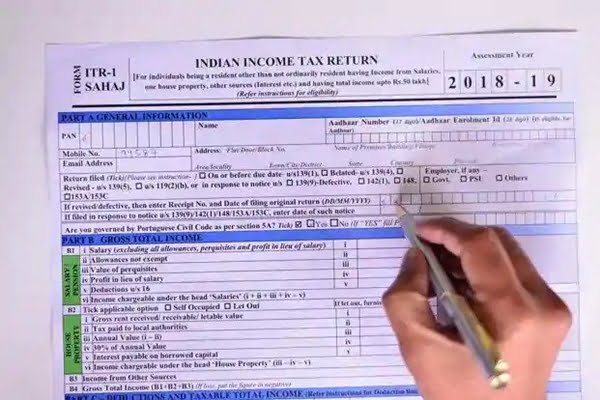

CBDT said that taxpayers who have not verified their returns are being given a chance to verify it by the end of September. Taxpayers can send a signed copy of ITR-V form to the Income Tax Department or get it verified by any means of 5 electrons.

Why is this verification important?

Since taxpayers are not signed on electronically filed returns, it is important that taxpayers verify it through other means so that their return claim can be processed. This verification is done to ensure that the information given by the taxpayer is correct.

Through these means you can verify

In the circular issued by the CBDT, it has been said that incomplete return forms can also be verified through electronic means. For this, it can be verified by obtaining a password on the Aadhaar linked mobile number, login to the e-filing website of the Income Tax Department through net banking or bank account number, through a demat number or by ATM with the help of cash dispensers. .

If not verified, legal action will be taken

Normally, taxpayers are given an opportunity to verify this by 4 months of filing tax return through electronic means (e-Filling). If the verification process is not completed during this period, under the law, the department can take action on the taxpayer for not fulfilling the filing duty.

They will not get relief

However, this relief will not be for cases where the authorities have taken the necessary steps to ensure compliance. In some cases, the verification process has been delayed due to taxpayers and due to this, the authorities have taken steps. They will be excluded from the announced period today and interest will be charged on the refund.

The CBDT has said that such a one-time opportunity is being given to verify such returns and regularize such returns. At the same time, it has also been warned that if the tax is not regularized by the end of September by electronic means, then appropriate steps of legal provision will be taken.