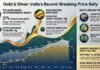

Key Highlights

- Gold prices plummeted 3.4% to $4,201.65 per ounce after hitting an all-time high of $4,381

- Silver experienced a sharper 7% decline, falling to $48.95 per ounce

- US-China trade reconciliation talks triggered massive profit-booking by investors

- Indian markets may see gold prices drop by over ₹1,000 and silver by ₹1,200-₹1,800 per kg

- Experts warn gold has entered “bubble territory” with prices 60% above 1980 peak levels

New Delhi: The precious metals market witnessed unprecedented volatility on Tuesday, October 21, 2025, as both gold and silver prices crashed dramatically from their record highs. After months of relentless upward momentum that saw investors flocking to safe-haven assets, the markets reversed course with gold falling nearly 4% and silver declining by a significant 7%. The sharp correction came amid growing optimism about US-China trade relations and widespread profit-booking by investors who had ridden the precious metals rally to historic peaks.

Historic Price Correction in the Gold Market

The gold market experienced one of its most significant single-day declines in recent memory on Tuesday. Spot gold tumbled 3.4% to settle at $4,201.65 per ounce, marking a substantial retreat from Monday’s all-time high of $4,381 per ounce. December gold futures also couldn’t escape the selling pressure, slipping 0.5% to close at $4,217 after opening at $4,371. The intraday decline represented a loss of more than $150 per ounce, as investors rushed to lock in gains after the extended bull run.

What Triggered the Sudden Reversal?

According to a comprehensive CNBC International report, the catalyst for this dramatic shift came from unexpected positive developments in US-China relations. President Donald Trump publicly expressed optimism about reaching a “strong and fair trade deal” with China, announcing that leaders from both nations are scheduled to meet in South Korea next week. Adding to the positive sentiment, US Treasury Secretary Scott Bessent is set to hold crucial talks with the Chinese Vice Prime Minister in Malaysia in the coming days.

These diplomatic breakthroughs significantly reduced geopolitical tensions that had been driving investors toward gold as a safe-haven asset. As fears of prolonged trade conflicts subsided, investors began redirecting capital toward riskier, higher-yield assets. The reduced political uncertainty undermined gold’s traditional role as a hedge against instability, triggering widespread profit-taking across precious metals markets.

Expert Analysis: Gold Enters Bubble Territory

Market analysts are now raising serious concerns about gold’s valuation levels. John Hingis, a respected analyst at Capital Economics, issued a stark warning that gold has entered “bubble territory.” His analysis reveals that current gold prices are significantly inflated not only compared to historical inflation-adjusted levels but also relative to other real assets.

Hingis provided compelling historical context: at the beginning of 2025, gold was trading near its 1980 peak levels. However, the metal has since surged 60% above that benchmark and now trades at approximately three times the 1980 average price when adjusted for inflation. This dramatic appreciation has raised questions about sustainability and the potential for further corrections.

Broader Precious Metals Selloff

The price pressure wasn’t limited to gold alone. Silver, often more volatile than gold, suffered the steepest decline, falling 4.8% to $48.95 per ounce. Platinum also faced significant headwinds, dropping 5.3% to close at $1,565 per ounce. Industrial metals weren’t spared either, with copper futures declining 0.6% to $10,624 per tonne, and US copper falling 1.1% to $4.98 per pound. The across-the-board selloff suggests a fundamental shift in investor sentiment across commodity markets.

Indian Market Impact and Price Trajectory

The international price crash is expected to significantly impact the Indian precious metals markets on October 22. Throughout October, Indian gold prices have been on a roller-coaster ride. Starting at ₹1,16,903 per 10 grams (999 purity) on October 1, prices peaked around October 20 at ₹1,32,900, driven by Diwali festival buying and record-breaking sales volumes.

However, the international decline of approximately 3% in gold and 6% in silver on October 21 will likely translate into sharp domestic corrections. Indian markets face a unique situation as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) remained closed on October 22 for the Balipratipada holiday, though the Multi-Commodity Exchange (MCX) will open in the afternoon session.

Industry experts predict that once rates are officially released by the Indian Bullion and Jewellers Association (IBJA), gold prices could fall by more than ₹1,000 per 10 grams, while silver may decline by ₹1,200 to ₹1,800 per kilogram. This would bring gold prices down from the October 20 level of ₹1,32,900 to potentially around ₹1,31,900 or lower, depending on the exact international movements and rupee-dollar exchange rates.

Market Outlook and Investor Implications

The sudden reversal in precious metals prices serves as a reminder of market volatility and the risks of extended bull runs. Investors who entered positions at peak levels may face short-term losses, while those who have held gold and silver for longer periods still sit on substantial gains. The coming weeks will be crucial in determining whether this correction represents a healthy pullback or the beginning of a more sustained downtrend. Market participants will be closely monitoring the upcoming US-China meetings and any further diplomatic developments that could influence safe-haven demand.