Key Points:

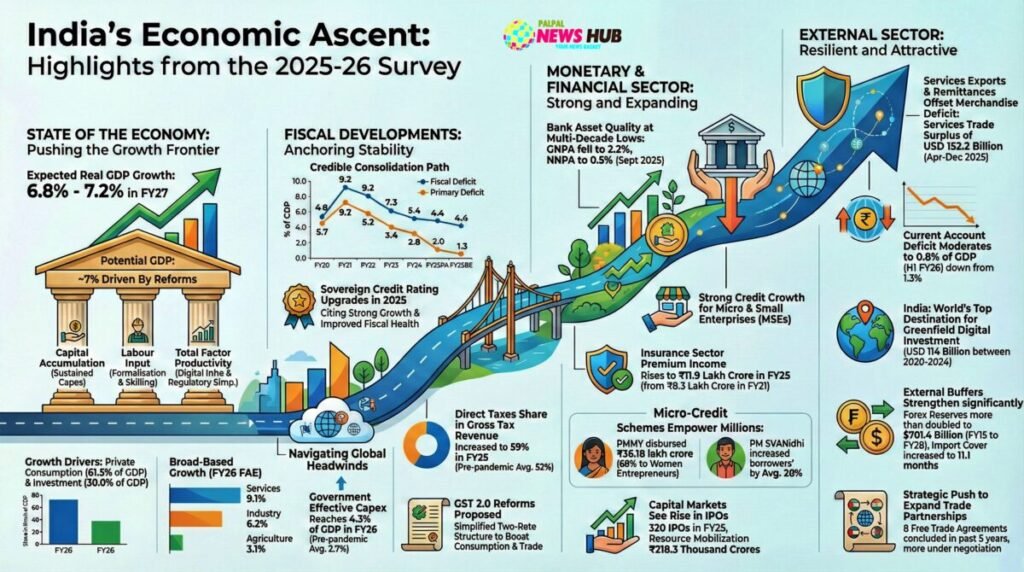

- Economic Survey 2025-26 tabled ahead of Union Budget 2026

- Real GDP growth for FY26 projected at around 7.3% to 7.4%

- FY27 GDP growth estimated between 6.8% and 7.2%

- Retail inflation drops to 1.7% during April-December 2025

- Food inflation enters deflationary zone after June 2025

Ahead of the Union Budget 2026 scheduled for February 1, Finance Minister Nirmala Sitharaman presented the Economic Survey 2025-26 in Parliament on Thursday. The survey reviews India’s economic performance in 2025 and lays out key macroeconomic projections for the coming years.

According to the first advance estimates, India’s real GDP growth for FY26 is projected in the range of 7.3% to 7.4%, indicating continued economic momentum. For FY27, real GDP growth is estimated to moderate slightly but remain strong, ranging between 6.8% and 7.2%, supported by domestic demand, investment activity, and macroeconomic stability.

Inflation Drops to Multi-Year Low

One of the most significant takeaways from the Economic Survey is the sharp decline in retail inflation. Inflation, as measured by the Consumer Price Index (CPI), fell to just 1.7% during the April-December 2025 period, reflecting the impact of sustained government measures to control prices.

The survey notes that inflation in India has declined to one of its lowest levels in recent years, offering major relief to households and strengthening consumption prospects.

Why Retail Inflation Declined

The moderation in inflation has been largely driven by falling food and fuel prices. Food and fuel together account for about 52.7% of India’s CPI basket, meaning any easing in these components has a direct and significant impact on headline inflation.

The survey highlights that India recorded the fastest decline in inflation among emerging economies. Headline inflation fell by around 1.8 percentage points in 2025 compared to 2024, suggesting that price pressures eased more rapidly in India than in many peer economies.

Food Inflation Turns Negative

The most notable development has been the sharp and sustained decline in food inflation. After June 2025, food inflation entered the deflationary zone, indicating that food prices, on average, began to fall instead of rising.

The steepest monthly decline in the CPI food index was recorded in October 2025, when food inflation dropped by approximately 5.02%. This marked a turning point in overall price stability.

Falling Vegetable and Cereal Prices Lead to Relief

The primary driver of lower food inflation was the continuous fall in vegetable prices, which remained in negative territory for most of the year. Pulse inflation also declined steadily for nearly nine months, while spice prices stayed in deflation for around 18 months, though at a slower pace.

Cereal inflation showed a significant moderation as well. From 6.2% in January 2025, cereal inflation fell to minus 0.4% by December 2025. The combined easing of prices across vegetables, pulses, spices, and cereals played a crucial role in pulling down overall inflation to record low levels.

Economic Implications

The Economic Survey suggests that lower inflation creates space for sustained growth by boosting purchasing power, stabilizing interest rates, and improving overall macroeconomic resilience. With growth remaining robust and inflation under control, the findings set a positive backdrop for the Union Budget 2026.