Key Highlights

- Uniform Recovery Standards: The RBI will harmonize disparate rules for banks and NBFCs, enforcing legal and respectful conduct for all recovery agents.

- Mis-selling Curbs: New draft instructions will mandate that third,party products sold at bank counters must strictly align with a customer’s risk appetite and financial needs.

- Fraud Compensation: A new framework proposes to compensate victims of small,value digital frauds up to ₹25,000, covering up to 85% of the lost amount.

- Enhanced Digital Safety: The central bank will release a discussion paper on additional security measures, such as lagged credits and dual authentication for senior citizens.

- Financial Inclusion Boost: The limit for collateral,free MSME loans has been doubled from ₹10 lakh to ₹20 lakh, alongside the launch of “Mission SAKSHAM” for cooperative bank training.

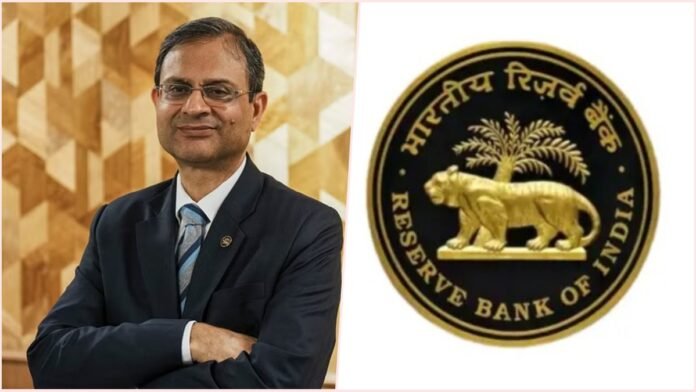

The Reserve Bank of India (RBI) is moving toward a more customer,centric regulatory environment with the announcement of three major draft guidelines. Following the Monetary Policy Committee (MPC) meeting on February 6, 2026, Governor Sanjay Malhotra emphasized that while the repo rate remains steady at 5.25%, the central bank’s immediate priority is the elimination of arbitrary and coercive practices in the retail banking space.

Currently, different categories of regulated entities (REs) follow varied sets of instructions regarding the engagement of recovery agents. The RBI now intends to review and harmonize these “extant conduct,related instructions” to ensure that every borrower, regardless of their lender, is treated with dignity. Under the upcoming rules, the accountability of banks and NBFCs will increase significantly, as they will be held directly responsible for any harassment or unethical tactics employed by their outsourced agents.

Curbing the Lure of Commissions: New Mis-selling Norms

A significant portion of the new regulatory push is directed at the “mis,selling” of third,party financial products, such as insurance and wealth management schemes, at bank branches. Governor Malhotra noted that such practices have “significant consequences” for both the consumer and the institution’s reputation.

The draft guidelines will codify advertising, marketing, and sales standards. Banks will no longer be permitted to push high,commission products that do not serve the client’s best interest. Instead, the suitability of the product must be commensurate with the individual client’s risk profile. This shift aims to restore trust in bank counters as reliable points of financial advice rather than mere sales hubs.

Revolutionary Safety Nets for Digital Fraud Victims

In a landmark move for digital payment safety, the RBI has proposed a framework to compensate customers for small,value fraudulent transactions. Recognizing that the first brush with fraud can be devastating, the central bank plans to offer a once,in,a,lifetime payout of up to ₹25,000, covering roughly 85% of the loss incurred. This initiative is designed to provide a safety net for those who may have inadvertently shared an OTP or fallen for a phishing scam, while simultaneously encouraging greater future vigilance.

Furthermore, a separate discussion paper will explore “lagged credits,” a system where large or suspicious transfers are held for a short period to allow for verification. These measures, along with a focus on additional authentication for vulnerable groups like senior citizens, represent the most significant update to customer liability rules since 2017.

Expanding Credit and Strengthening Inclusion

Beyond consumer protection, the RBI has also raised the financial ceiling for small businesses. The limit for collateral,free loans to Micro, Small, and Medium Enterprises (MSMEs) has been increased to ₹20 lakh from the previous ₹10 lakh, a move expected to stimulate credit flow in the manufacturing and service sectors.

To support the backbone of rural and urban banking, the central bank also announced “Mission SAKSHAM” (Sahakari Bank Kshamta Nirman). This initiative will provide physical and digital training to over 1.4 lakh participants in the Urban Cooperative Bank (UCB) sector, focusing on modernizing their technical and managerial capabilities to ensure they remain resilient in an increasingly digital economy.