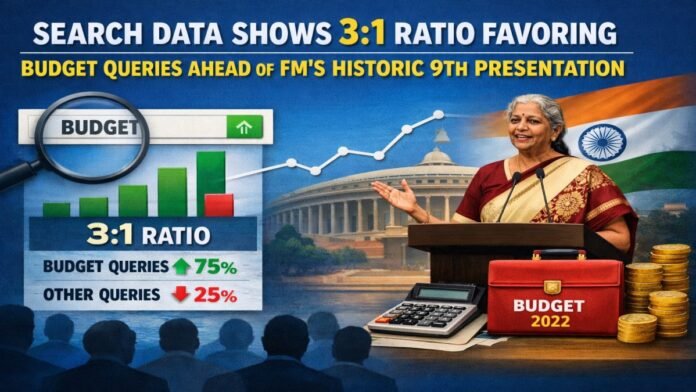

Key Points:

- “Budget” searches consistently outrank “income tax” queries by nearly 3:1 ratio in days surrounding Union Budget presentation

- Delhi leads with 75% budget-related searches compared to 25% for income tax in 2023

- 2024 interim budget saw highest budget search ratio at 81% due to election-year reduced tax expectations

- 2025 recorded 28% income tax searches, highest in three years, following ₹12 lakh exemption announcement

- Hindi-language budget speech live updates and highlight reels dominate post-presentation search trends

Finance Minister Nirmala Sitharaman is poised to create history on February 1st as she presents her ninth consecutive Union Budget, a record for any woman finance minister in India. As the country prepares for this fiscal milestone, digital behavior patterns offer compelling insights into public engagement with this annual economic event.

Google search data analyzed from the past three budget cycles demonstrates a clear and consistent pattern: Indian citizens demonstrate substantially greater interest in comprehensive budget information than in specific income tax provisions. Between January 30th and February 2nd each year, the search volume for the keyword “budget” consistently exceeds “income tax” by ratios approaching three to one, indicating broader curiosity about the government’s overall economic vision rather than just personal tax implications.

State-wise Analysis Reveals Regional Variations

The 2023 data provides a representative baseline, when 75 percent of Delhi’s population searched for “budget” compared to 25 percent for “income tax.” Uttar Pradesh showed a nearly identical distribution at 74 percent versus 26 percent, while Bihar recorded 73 percent budget searches against 27 percent for tax-related queries. Southern states displayed marginally higher tax consciousness, with Kerala and Tamil Nadu registering income tax searches slightly above the 30 percent threshold, possibly reflecting higher salaried class penetration and tax compliance awareness.

The 2024 interim budget, presented during the general election year, witnessed an even more pronounced skew toward budget searches. Delhi registered 81 percent budget queries against just 19 percent for income tax, as the government traditionally avoids major tax announcements in vote years. Interestingly, northeastern states displayed divergent behavior; Arunachal Pradesh and Manipur recorded over 40 percent income tax searches, suggesting either higher taxpayer concentration or specific regional economic concerns.

The 2025 Inflection Point

Last year’s 2025 budget marked a significant turning point. Following the announcement of income up to ₹12 lakh tax-free under the new tax regime, income tax searches jumped to 28 percent in Delhi, while budget searches stood at 72 percent. This represented the highest tax-related search volume in the three years, indicating that substantive policy changes do drive targeted information seeking. Uttar Pradesh mirrored this trend with 74 percent budget and 26 percent tax searches, showing the policy’s nationwide impact.

Search Behavior Decomposition

Google Trends data reveals specific information pathways citizens follow post-budget announcement. The Finance Minister’s speech in Hindi emerges as the most sought-after content, with searches for “budget speech highlights,” “budget speech time,” and “budget live updates” dominating query volumes. This indicates strong demand for real-time, accessible information in vernacular languages.

Technical tax terminology only gains traction after initial consumption of broad highlights. Keywords such as “tax slabs,” “new vs old tax slabs,” “tax rebate meaning,” and variations of “income tax calculator” surge in the 24 to 48 hours following the speech. This pattern suggests a two-stage information consumption model: first, citizens seek to understand the government’s overall economic narrative, then they drill down into personal financial implications.

Digital tools have become integral to this process. Income tax calculators from government portals and private financial websites see traffic spikes exceeding 300 percent in the week following budget presentations. Comparative analysis searches between old and new tax regimes have remained consistently popular since the dual regime system was introduced, with peaks correlating directly to major exemption threshold changes.

What to Expect for Budget 2026

As India approaches the 2026 budget presentation, similar digital trends are anticipated with potential enhancements. The increasing smartphone penetration in rural India and expanding digital literacy are expected to broaden the search demographic beyond traditional urban, salaried-class centers. Real-time fact-checking and analysis from financial influencers on social media platforms may complement Google searches, creating a more complex information ecosystem.

Finance Minister Sitharaman’s unprecedented ninth consecutive budget presentation places her in a unique position to address citizen expectations, as reflected in these search patterns. The data suggests voters seek transparency, clarity, and direct communication about how economic policies will affect their daily lives. The consistently high ratio of budget-to-tax searches indicates that Indians view the Union Budget not merely as a tax code update but as a comprehensive statement of national direction.

With the entire nation watching, the focus remains on whether this year’s budget will continue the trend of citizen-centric announcements while balancing fiscal prudence with growth imperatives. The digital footprint left by millions of searches will provide immediate feedback on how effectively the government communicates its economic vision to the common citizen.