Key Points:

- 8th Pay Commission Terms of Reference (ToR) approval expected before Diwali 2025 after 237+ days delay

- Dearness Allowance (DA) and Dearness Relief (DR) likely to increase by 3% from 55% to 58% of basic pay

- Over 1.2 crore central government employees and pensioners to benefit from upcoming announcements

- Implementation of 8th Pay Commission expected from January 1, 2026, but final approval may come by 2027-2028

- Fitment factor estimated between 1.8 to 2.46, potentially increasing minimum wage from ₹18,000 to ₹41,000

- Employee unions express growing discontent over prolonged delays in DA announcements

- 8th Pay Commission could benefit 48.62 lakh employees and 67.85 lakh pensioners with salary hikes of ₹20,000-25,000

New Delhi: Central government employees and pensioners are on the verge of receiving significant financial relief as the government prepares to make crucial announcements regarding salary revisions and allowance increases before the upcoming Diwali festivities.

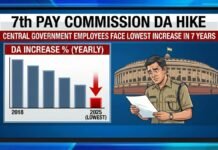

Long-Awaited DA Hike Finally on Horizon

The much-anticipated 3% increase in Dearness Allowance (DA) and Dearness Relief (DR) is expected to be announced soon, raising the current rate from 55% to 58% of basic pay. This increment, designed to offset inflationary pressures, will provide immediate financial relief to over 1.2 crore central government employees and pensioners across the country.

The delay in DA announcement has created significant unrest among government employee unions, with the Confederation of Central Government Employees and Workers (CCGEW) formally expressing their displeasure to Finance Minister Nirmala Sitharaman. The union’s letter highlighted the growing discontent among employees who have been waiting for months for this essential allowance revision.

Financial experts estimate that a 3% DA increase will translate to substantial monetary benefits for employees across all pay scales, with higher-grade officers receiving proportionally larger increments. The revision follows the established pattern of the 7th Pay Commission recommendations and addresses the rising cost of living experienced throughout 2025.

8th Pay Commission Terms of Reference Breakthrough

After an unprecedented delay of over 237 days since the January 16, 2025 cabinet approval, the Terms of Reference (ToR) for the 8th Pay Commission are finally expected to receive government clearance before Diwali. This approval will mark the formal constitution of the commission and set the framework for comprehensive salary and pension revisions.

The extended delay in ToR notification has raised concerns among stakeholder groups, particularly when compared to the 7th Pay Commission’s timeline, which saw ToR approval within 156 days of announcement. Government sources indicate that the delay resulted from extensive consultation processes with various ministries and state governments to ensure comprehensive coverage of all employee categories.

Union Minister of State for Finance Pankaj Chaudhary confirmed that inputs for ToR were sought from the Ministry of Defence, Ministry of Home Affairs, Department of Personnel & Training, and all state governments in January and February 2025, with additional suggestions still being received.

Revolutionary Salary Structure Changes Ahead

The 8th Pay Commission is projected to recommend fitment factors ranging between 1.8 to 2.46, representing a substantial multiplication factor for salary calculations. Industry analysts suggest that the higher end of this range could result in minimum wage increases from the current ₹18,000 to approximately ₹41,000, marking a dramatic 127% increase in basic pay structures.

Brokerage firms estimate that central government employees could see salary hikes ranging between ₹20,000 to ₹25,000 monthly, with the total benefit package including revised allowances and pension components. The commission’s recommendations will cover 48.62 lakh active employees and 67.85 lakh pensioners, making it one of the largest salary revision exercises in Indian administrative history.

The projected salary increase of 30-34% represents a significant improvement over previous pay commission increments, reflecting the government’s commitment to maintaining competitive compensation packages for public sector employees. However, employees should note that DA will reset to zero upon implementation, which typically moderates the immediate financial impact.

Implementation Timeline and Realistic Expectations

While the 8th Pay Commission is scheduled for implementation from January 1, 2026, historical precedents suggest that actual benefit realization may extend to 2027 or even 2028. The commission typically requires 18 months to submit recommendations, followed by 3-9 months of government review before final approval.

Previous pay commission timelines provide insight into expected delays: the 6th Pay Commission took 22-24 months from formation to implementation, while the 7th Pay Commission required similar timeframes despite technological advances in data processing and consultation mechanisms.

The All India Consumer Price Index for Industrial Workers (AICPI-IW) data for July 2025 showed an increase from 145 to 146.5 points, indicating continued inflationary pressures that will influence the commission’s final recommendations. This economic indicator directly impacts fitment factor calculations and minimum wage determinations.

Economic Impact and Financial Implications

The 8th Pay Commission implementation is expected to boost economic consumption significantly, similar to the ₹1 lakh crore expenditure increase following the 7th Pay Commission. Government economists anticipate that enhanced purchasing power among central employees will stimulate domestic demand and support overall economic growth.

State governments and public sector undertakings typically align their pay scales with central government revisions, potentially extending benefits to millions of additional employees across India’s public sector ecosystem. This cascading effect multiplies the economic impact beyond direct central government beneficiaries.

The government faces the challenge of balancing employee welfare with fiscal prudence, ensuring that salary increases remain sustainable within broader budgetary constraints while maintaining competitiveness with private sector compensation packages.